Floki’s price is showing strong volatility as it tests a key resistance level. According to CoinMarketCap, FLOKI was trading at $0.000096 at the time of writing, down 1.62% in the past 24 hours. The token’s trading volume surged to $103.66 million.

The global crypto market cap slipped by 0.68% to $3.86 trillion, while daily market volume rose 16.71% to $154.74 billion.

Crypto analyst Bitcoinsensus recently pointed out on X that FLOKI has been trending within a rising price channel since April 2025. Previous rallies from the channel’s low have seen gains of 170% and 160%.

His chart shows the current rally has far exceeded the usual rise of practically 70% to 230%, nearly pushing FLOKI to the top of its price range. However, this could lead to “throw-over” where, for about a moment, prices can go beyond their usual limit before they drop very swiftly.

Market Sentiment and On-Chain Data

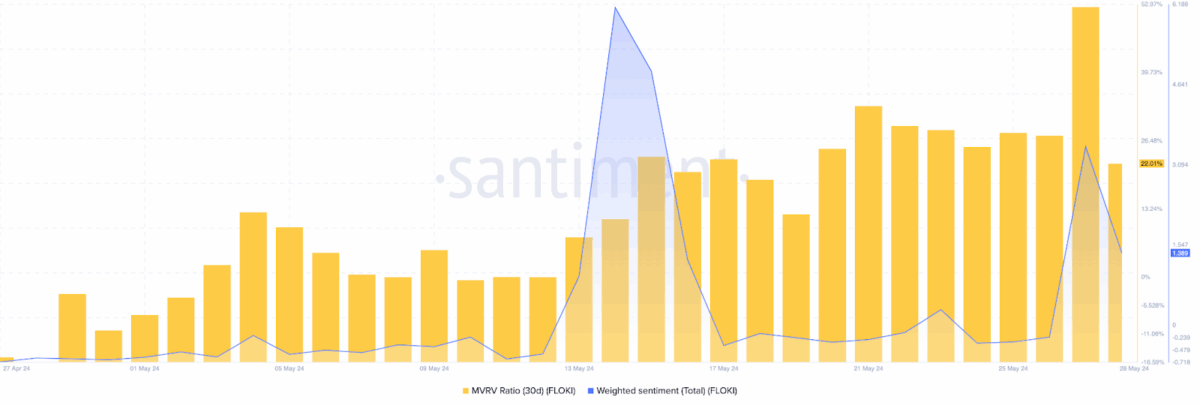

On-chain data from Santiment reveals that FLOKI’s MVRV ratio, which tracks holders’ profits, rose steadily in May and reached 22.01% by month’s end. This implied that a large number of investors were making money. As traders lock in gains, this makes selling pressure more likely.

Moreover, weighted sentiment spiked sharply around May 13, showing high excitement, but it quickly fell into negative territory days later.

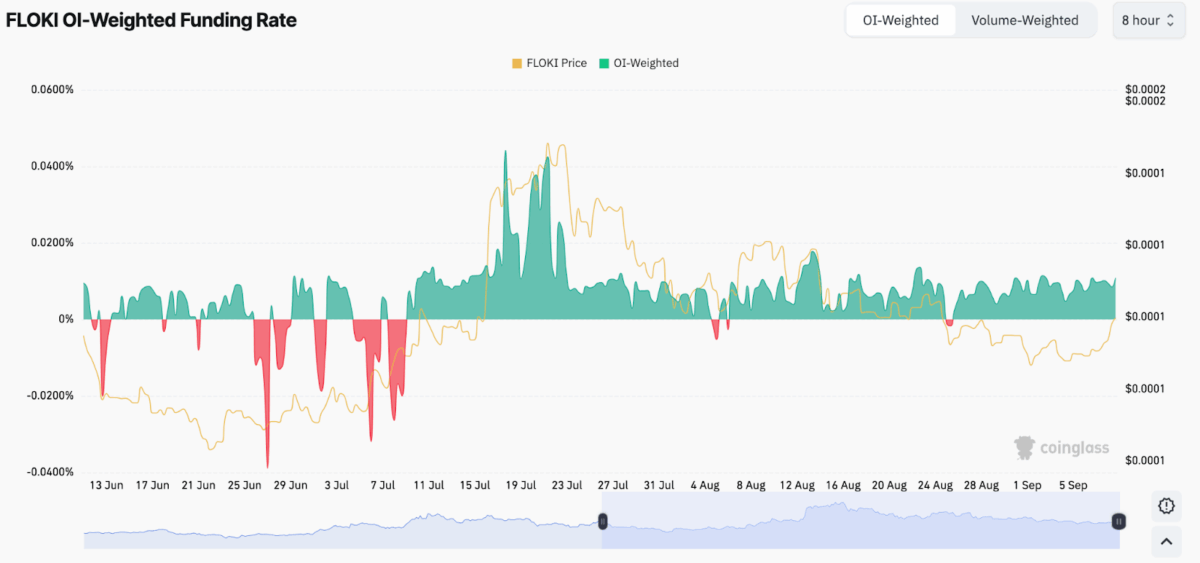

Coinglass data helps with another picture. From mid-June to early July, the data shows funding rates dipping into the negative, indicating a lot of bearish sentiment. The lowest point hit on June 29, when it plummeted below -0.04%.

However, things took a turn in mid-July when funding rates bounced back into positive territory, which moved FLOKI to its peak on July 23. Since then, both the price and funding rates have settled down a bit, suggesting a more balanced market ending in September.

Since late July, the funding rate and FLOKI’s price have declined gradually. And now, this early September, the funding rate is positive. Hence, the market is stabilizing as people wait for the next move.

FLOKI’s short-term future hinges on holding support near $0.40. A push above $0.49 may start another rally, but a drop below $0.38 may lead to heavier selling.

Also Read: FLOCK Jumps 61% After Coinbase DEX Listing as Bulls Return