The crypto market is displaying bullish momentum today as investor sentiment changes. In fart, the whole market is in green with major tokens up an average 2-5% in a day. As a result of that, the overall market valuation has climbed by 2.21% to $3.96 trillion, with over $156 billion recorded in trading volume.

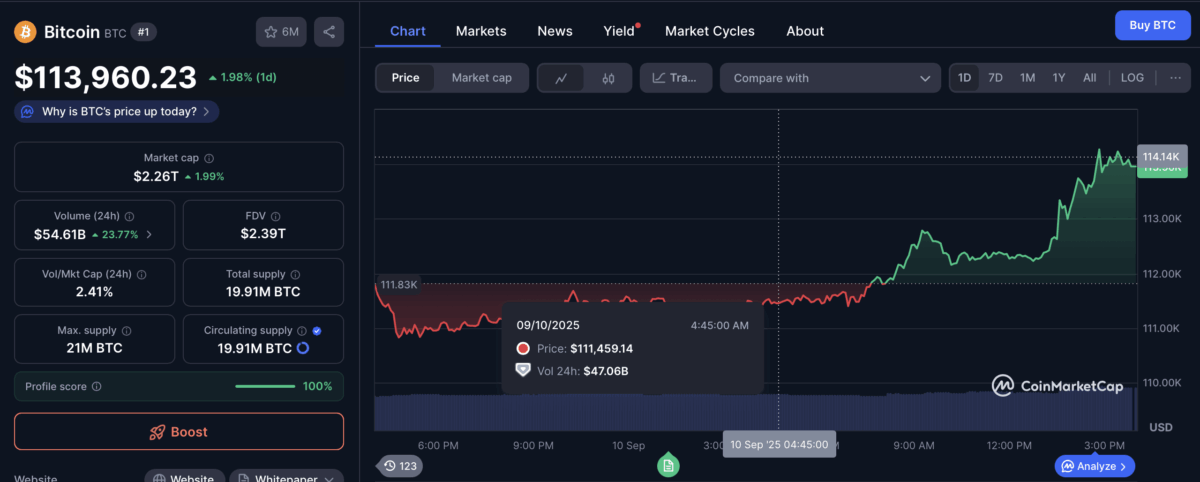

Bitcoin Surge above $112k Level

At the time of writing this report, Bitcoin is up $113,978. This is up 1.51% from $112k which is as been consolidating for the past few days. The token even reached $114k with a break of structure during the new york season before retracing.

In addition to that, the token saw a 24% surge in trading activity over the same period. This is about $54 billion in volume, which leads to $2.26 trillion in market cap.

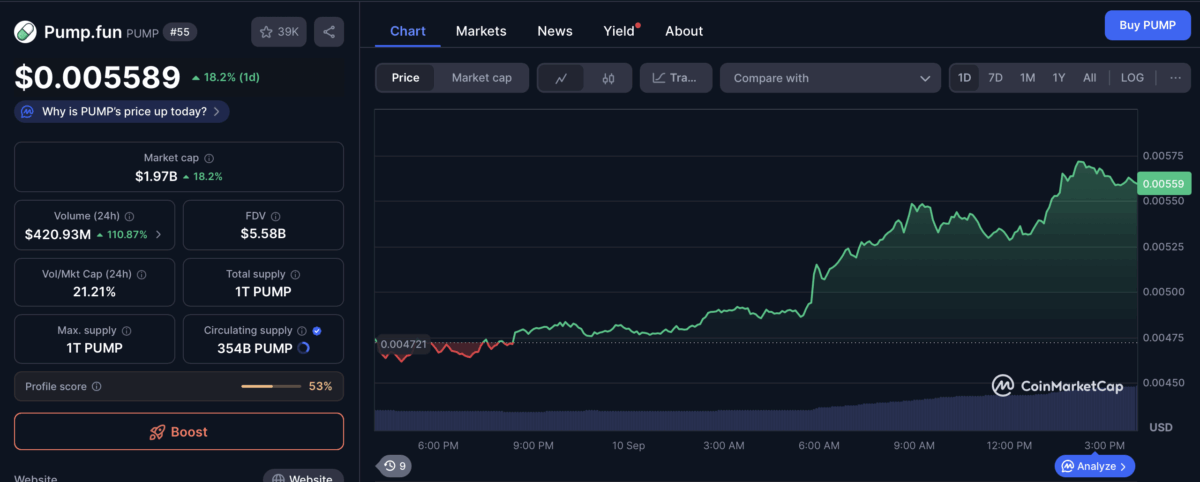

Pump.fun Spikes up by 19% in 24 Hours

Pump.fun (PUMP) saw the most surge, 19.24% from the previous day, thanks to the massive 111% increase in activity during the trading period.

Currently, PUMP is trading for $0.005588, after trading at a daily low of $0.004744 during the assassin season. It recorded $421 million in trading volume and $1.97 billion in market cap.

Story IP Drops After Bullish Days

Not all altcoins are bullish, Story IP saw the most drop despite bullish sentiment. Meanwhile, the token has been spiking up for days, and even surged over 28% in the last 7 days.

However, the token’s bullish run seems to be over as it’s down 6.24% today. Currently, it’s trading for $10.30 from a daily high of $10.98. Trading activity has also dropped by 24.6% to $331.87 million, which results in 6% drop in its market cap to $3.13 billion, according to data from CoinMarketCap.

Top Gainers & Losers

| Gainers | Losers |

|---|---|

| Pump.fun (PUMP): +20.40% | MYX Finance (MYX): -10.04% |

| Mantle (MNT): +15.92% | Story (IP): -8.61% |

| Avalanche (AVAX): +10.59% | Ethena (ENA): -1.73% |

| Pyth Network (PYTH): + | Celestia (TIA): -1.18% |

Market Sentiment

The Fear & Greed index is now at 43, which means investors have continued to remain neutral on their sentiment. Also the Altcoin Season Index is at 61%, meaning that investors are looking more into investing in Bitcoin over altcoins.

Meanwhile, data from Coinglass shows that 129,810 traders were liquidated from their positions in the last 24 hours. That’s about $227 million in total. $72.31 million of that was from traders who bet on long positions, while $155.38 million came from short positions traders.

Also Read: Gemini Increases IPO Target to $433M With Share Price of $26