A new report from crypto exchange Bybit and financial analysis company FXStreet says that next week will be very important for global markets, such as stocks and cryptocurrencies. The focus of the study is on the upcoming U.S. Producer Price Index (PPI) and Consumer Price Index (CPI), which are likely to have a big impact on the Federal Reserve’s interest rate decision on September 17.

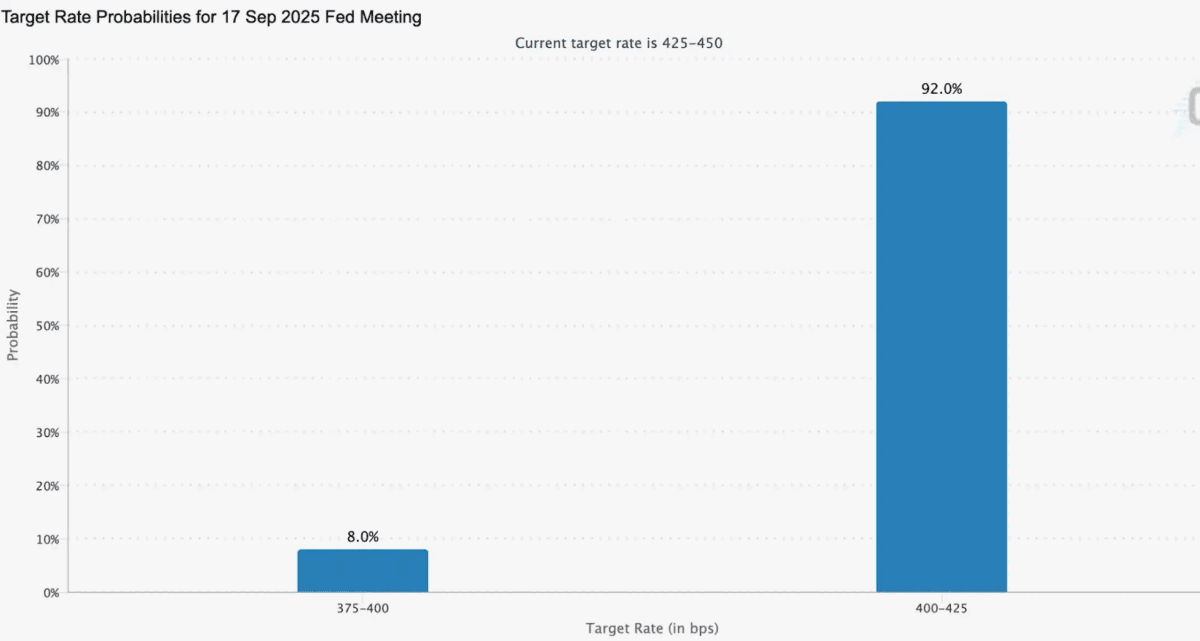

According to the Bybit x FXStreet TradFi Report, traders are bracing for significant volatility as these inflation metrics will provide the final key data points before the central bank’s policy meeting. “It’s a critical week for inflation ahead of the Fed’s rate decision on Sep 17, 2025,” the report states. Currently, markets are pricing in a 92% probability of the Fed cutting its benchmark rate from 4.5% to 4.25%.

Inflation Data to Steer Fed Policy

The PPI data is scheduled for release on September 11, followed by the CPI data on September 12. The report notes that these figures “will powerfully shape expectations” for the Fed’s next move. The consensus forecast for the year-over-year CPI is a slight increase from 2.7% to 2.9%. A reading above this level could diminish the likelihood of a rate cut and potentially trigger a market-wide correction. Conversely, softer inflation data would bolster the case for monetary easing, which typically benefits risk assets by increasing market liquidity.

That being said, the report says that “Bitcoin faces a major breakout or breakdown, based on the CPI outcome.” If the CPI number is good and lower than expected, it could push bitcoin above its key resistance level of $117,300 and its most recent all-time high of $124,500.

The study shows that if the Fed becomes less strict, the stock could rise to $135,000 by the end of the year. But a drop below the important support level of $107,200 could mean a big risk of going down.

The implications extend to traditional finance as well, with the S&P 500 holding above the 6,500-point pivot level. A positive inflation report could fuel the ongoing equity rally, with the report noting, “The S&P 500 is eyeing 7,000, as lower inflation could extend the equity rally”. The analysis provides traders with strategies to navigate the potential price swings across asset classes.

This week’s inflation data is more than just another economic update; it is a critical determinant for the Federal Reserve’s short-term monetary policy. For investors and traders, the CPI and PPI reports serve as the primary catalyst that could either validate the market’s expectation for a rate cut or force a significant repricing of assets.

If rates are lowered, it could bring more money into the world’s financial system. This could start the next rise in both crypto and stocks. On the other hand, continued inflation could confirm that interest rates will stay high for a longer time, which would cause the market as a whole to go down.

Also Read: Bybit slashes fees on stock CFDs and indices in TradFi power play