The MYX Finance token skyrocketed by over 173% in a single day. According to CoinMarketCap, as of writing, MYX trades at $7.55 with a 24-hour trading volume of $381.1 million, marking a 151.33% surge.

This unexpected rise follows Friday’s announcement that MYX Exchange would list the World Liberty Financial (WLFI) token, affiliated with U.S. President Donald Trump and some family members.

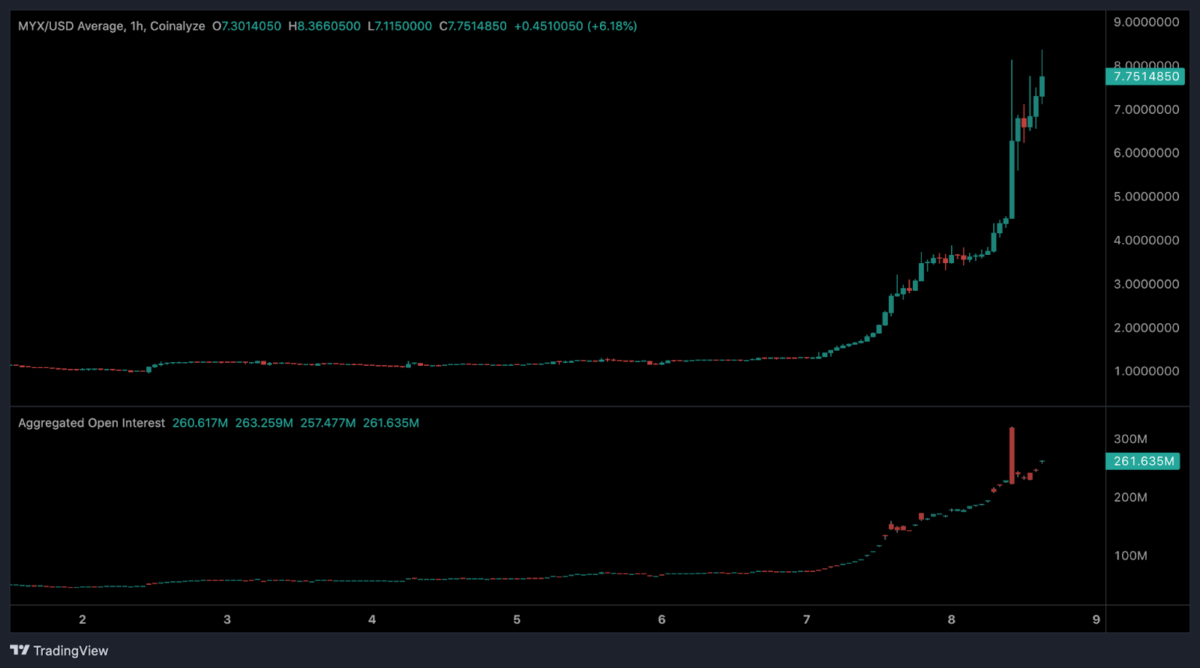

MYX Exchange, a finalist in the Binance Chain Awards on August 27, officially listed the WLFI/USDT trading pair, driving a sudden wave of interest. Coinalyz data shows MYX’s price remained flat for days before suddenly breaking out on September 7. The token jumped from $1 to over $7.75.

Rising Speculation and Open Interest Surge

As shown on the chart, aggregated open interest climbed sharply to above $260 million. This jump indicates that more traders are getting into futures positions, which is fueling the rally. However, such a swift increase can often point to increased speculation and risk.

Dominic, a popular voice on X, raised concerns about suspicious market behavior.

“Some people need jail time for real, today there where some questionable activities going on with $MYX,” he posted.

Dominic pointed out several issues, such as exchange wash trading, forced short squeezes, and the exploitation of insider token unlocks. He alleged that big investors, or whales, intentionally drove up MYX’s price, resulting in the liquidation of over $10 million in short positions and creating a false sense of demand.

According to him, 39 million tokens were unlocked during this price surge, which allowed early investors to sell their tokens to unsuspecting retail buyers.

Dominic pointed out that on-chain data showed some coordinated activity from whales across PancakeSwap, Bitget, and Binance, which hints at a possible pump-and-dump scheme being orchestrated. “Retail traders are the exit liquidity. The insiders have already taken profit,” he added.

While MYX’s surge offers quick profits, manipulation risks are still high. Watching for upcoming token unlocks is necessary, as history suggests potential sharp downturns.

Also Read: PHNIX Token Surges 47% After Ripple CTO Changes X Profile