MARA has boosted its Bitcoin holdings to 52,477 BTC, valued at approximately $5.9 billion, according to its August production update, securing its place as the second-largest public bitcoin holder after Strategy.

The Nasdaq-listed firm mined 705 BTC last month, slightly edging out July’s 703 BTC production and capturing 4.9% of total network rewards. The figure includes transaction fees and accounts for BTC that is loaned, managed, or used as collateral.

According to data from Bitcoin Treasuries, MARA trails only Michael Saylor’s Strategy, which recently expanded its holdings to 636,505 BTC ($72 billion). Other major holders include Twenty One (43,514 BTC), Bitcoin Standard Treasury Company (30,021 BTC), and Bullish (24,000 BTC).

“Given the decline in bitcoin price during the month, we took the opportunity to strategically add to our treasury,” said MARA CEO Fred Thiel.

MARA’s Mining Momentum

MARA maintained its pace with 208 bitcoin blocks mined in August, matching July’s tally, despite a 6% increase in global hashrate to 949 EH/s. The firm’s own energized hashrate rose by 1% to 59.4 EH/s, bolstered by full operational deployment at its Texas wind-powered facility.

With over 59 EH/s online, MARA joins an exclusive club of mega miners, alongside IREN, CleanSpark and Cango, each pushing past the 50 EH/s barrier in the escalating hashrate arms race. Meanwhile, bitcoin’s total network hashrate recently crossed the one zetahash mark.

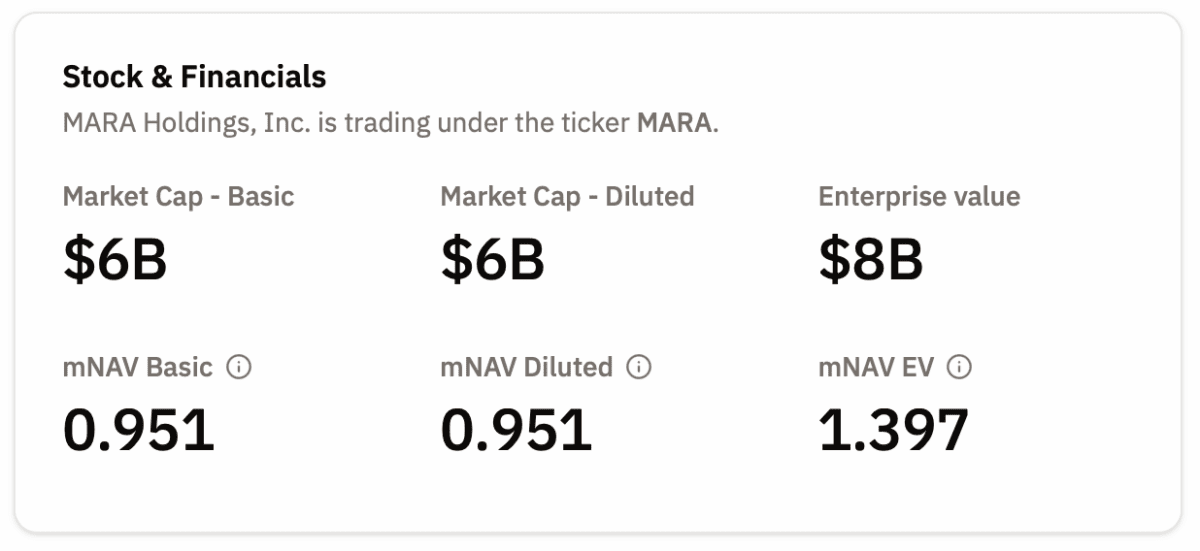

Despite mining efficiency gains, MARA’s stock has declined 4.9% in the past month and is down 13.5% year-to-date. It recently lost its title as the largest public bitcoin miner by market cap to IREN, whose AI-focused strategy fueled a 59.4% stock surge last month, pushing its valuation to $7.7 billion. MARA holds a $6.1B market cap, falling behind IREN’s recent surge and edging out Riot’s $4.3B valuation.

Bitcoin Runs the Treasury

MARA’s “full HODL” playbook, adopted in mid-2024, eliminates bitcoin liquidations. Instead, it leans on balance sheet cash and capital markets to fuel operations, anchoring its treasury strategy in BTC rather than fiat.

“We believe bitcoin is the world’s best treasury reserve asset,” Thiel stated. “We support the idea of sovereign wealth funds and corporations holding bitcoin as a core reserve.”

The company has also used capital markets to scale its stack, announcing a $700 million convertible note offering last December to repurchase debt and acquire additional BTC.

Scaling Mines and Global Reach

MARA acquired a majority stake in EDF’s Exaion in August, targeting AI-powered edge infrastructure with plans to boost its ownership to 75% by 2027. Its new Paris HQ signals that Europe is next in line for bitcoin expansion.

Thiel emphasized the firm’s dual focus on energy optimization and grid stabilization through strategic partnerships. “Together, these announcements reinforce MARA’s role in advancing energy partnerships dedicated to stabilizing power grids while capturing and repurposing unused energy,” he said.

Also Read: Bybit Pay Partners With SettlePay to Boost Crypto Payments