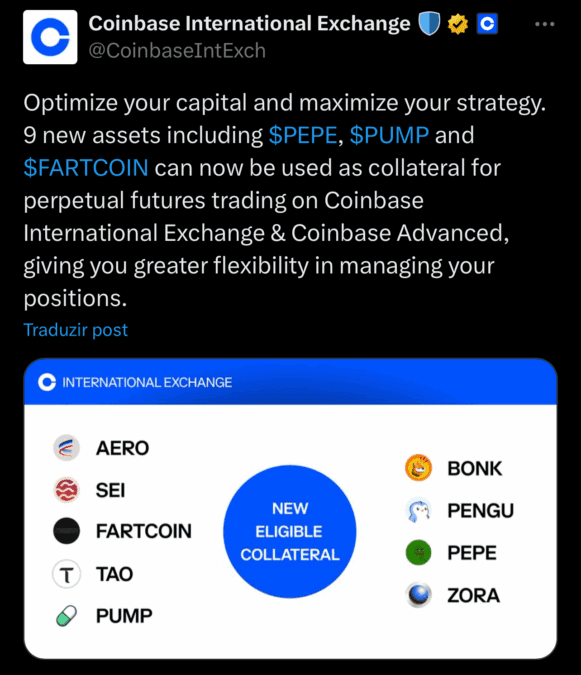

Coinbase has added nine new tokens, including Sei (SEI), Pepe (PEPE), Bonk (BONK), and Pump.fun (PUMP), as eligible collateral for perpetual futures trading on Coinbase Advanced and Coinbase International Exchange. The move, announced Friday, signals a broader push to capitalize on altcoin liquidity while ramping up leverage access for global users.

The collateral expansion, which also includes Bittensor (TAO), Fartcoin (FART), Pudgy Penguins (PENGU), and Aerodrome Finance (AERO), follows Coinbase’s earlier June upgrade that introduced a dozen other assets, including Aave (AAVE) and NEAR Protocol (NEAR). With this latest rollout, users in eligible jurisdictions can now post these tokens to open or maintain leveraged futures positions.

Coinbase’s international arm has also increased the maximum available leverage from 20x to 50x — a move likely to appeal to high-frequency traders and institutions seeking capital efficiency in volatile markets. PUMP and AERO jumped on the news, bucking the broader market slide tied to U.S. jobs data.

Market and Industry Impact

While the U.S. exchange remains restricted from offering these products domestically, Coinbase’s growing global derivatives suite underscores how centralized exchanges are leaning harder into perpetuals, especially as spot volumes stagnate. With DEX activity rising and meme tokens crowding Base, the platform’s DEX integration in August also allowed select U.S. users to explore newer, on-chain assets like Virtuals AI Agents and SoSo Value Indices.

Coinbase’s expanding derivatives strategy reflects a changing market dynamic: leverage-hungry altcoin traders are no longer confined to offshore venues. With altcoins like PEPE and BONK now eligible for collateralized trades, Coinbase is betting that meme token volatility isn’t a threat — it’s fuel.

Also Read: Trump Media Buys $105M in Cronos Tokens from Crypto.com