ETHZilla Corporation (Nasdaq: ETHZ) announced plans to deploy approximately $100 million worth of Ethereum (ETH) in the top liquid restaking protocol, Ether.fi. This establishes ETHZilla as a potential hub for big buyers and is its first interaction with decentralized finance (DEFI) protocols for treasury management.

Ether.fi’s will play the major league in this initiative. Restaking gives users the opportunity to stake Ethereum and earn incentives for protecting the network. They can also use the staked assets to support other protocols, which increases yield, so it can increase participants’ return opportunities and capital efficiency.

“Our partnership with EtherFi represents a strategic evolution in our treasury management approach,” said McAndrew Rudisill, Executive Chairman of the Company. “By deploying $100 million into liquid restaking, we’re reinforcing Ethereum’s security while unlocking incremental yield opportunities to enhance returns on our treasury holdings. Partnering with EtherFi marks a pivotal step in our engagement with DeFi, aligning innovation with prudent asset stewardship.”

EtherFi Selected for Institutional-Grade Yields

EtherFi was chosen for its ability to deliver incremental yield beyond standard ETH staking through restaking protocols while simultaneously reinforcing Ethereum’s security infrastructure.

“We are incredibly excited by ETHZilla’s pioneering approach to how treasury companies can strategically optimize their holdings,” said Mike Silagadze, Founder and CEO of EtherFi. “Their commitment highlights the growing institutional confidence in decentralized protocols and showcases a truly unique method to bridging traditional finance with the innovative power of the Ethereum ecosystem. We are proud to work with ETHZilla to demonstrate the significant value that liquid restaking can bring to forward-thinking treasuries.”

Treasury Holdings and Financial Position

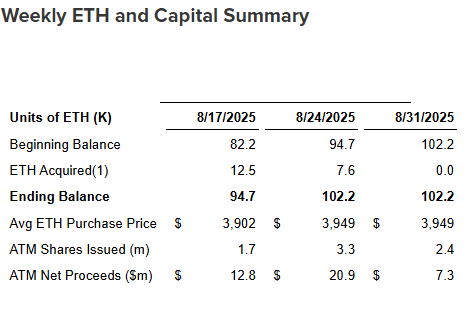

ETHZilla has been steadily accumulating a significant ETH treasury. As of August 31, 2025, ETHZilla holds:

- Total ETH & ETH Equivalents: 102,246 ETH

- USD Value: Approximately $456 million

- Average Acquisition Price: $3,948.72 per ETH

- Cash Equivalents: Approximately $221 million

- Shares Outstanding: 166,626,845 (as of September 1, 2025)

The company funded acquisitions through At-The-Market (ATM) share offerings, raising $40.9 million in net proceeds during August 2025. ETHZilla has been steadily accumulating a significant ETH treasury: 102,237 ETH as of August 31, 2025, which is worth about $425 million.

Corporate Actions and Strategic Outlook

Concurrent with the EtherFi announcement, ETHZilla completed the cancellation of 1,318,000 shares previously held by Elray Resources, Inc., for $1 million consideration as part of a previously announced settlement agreement.

The company indicated it will continue providing updates on treasury management and on-chain yield generation strategies through press releases and regulatory filings.

The $100 million investment in Ether.fi is a change from keeping ETH passively to actively making money through DeFi protocols, making the digital ecosystem stronger.

Also Read: ETHZilla Approves $250M Stock Buyback, Expands ETH Reserves