Google Cloud is creating a new blockchain platform called Google Cloud Universal Ledger (GCUL). Unlike other blockchains, this one is primarily designed for large financial institutions, rather than everyday users.

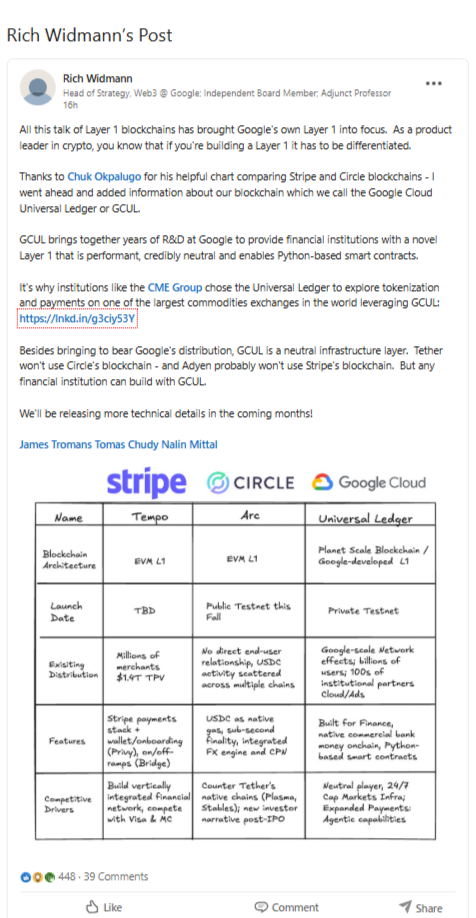

In a LinkedIn post, Rich Widmann,Global Head of Strategy for Web3 at Google Cloud, recently confirmed that GCUL should be considered a Layer 1 blockchain (like Ethereum or Solana). What makes it different is that it uses Python-based smart contracts, making it easier for developers to build financial applications.

The project was first revealed in March through a joint announcement with CME Group, one of the world’s largest commodities exchanges. CME has already completed the first phase of testing and states that GCUL could facilitate 24/7, low-cost settlement of items such as collateral, margin, and fees. Wider testing with market participants is expected later this year, and new services may launch in 2026.

Widmann also added, “Besides bringing to bear Google’s distribution, GCUL is a neutral infrastructure layer. Tether won’t use Circle’s blockchain – and Adyen probably won’t use Stripe’s blockchain. But any financial institution can build with GCUL.”

Circle, fresh off its IPO success, is getting ready to introduce Arc, a blockchain built for stablecoin payments and capital markets. Even Stripe is working on Tempo, a blockchain focused on payments that is compatible with Ethereum’s technology.

By contrast, GCUL aims to stand out with Google’s global scale, neutrality, and strong institutional partnerships.