Ethereum’s sudden drop is being called a rare chance for investors by Standard Chartered. On Tuesday, Ethereum traded at $4,547, slipping 0.64% in the past 24 hours, while Bitcoin fell 1.47% to $110,765.

The global crypto market cap also slid to $3.84 trillion, down 0.89% in one day. Despite the weakness, the bank argued in a research note on Tuesday that Ethereum’s pullback is less of a setback and more of an opening.

Geoffrey Kendrick, head of digital assets at Standard Chartered, believes Ethereum could rise to $7,500 by the end of 2025.

Since the beginning of June, ether (ETH) treasury companies have purchased 2.6% of total ETH in circulation. Combined with exchange-traded fund (ETF) inflows since then, the two have purchased a stunning 4.9% of all ETH in circulation.

“Although these inflows have been significant, the point is that they are just getting started,” Kendrick said.

Standard Chartered’s Call on ETH

Ethereum briefly hit $4,953 on Sunday, breaking its 2021 all-time high. Kendrick said fresh institutional demand has played a huge role in this rally. Last month, he predicted treasury companies would soon own 10% of all ETH in circulation.

He now says that the target is well on track. “ETH and the ETH treasury companies are cheap at today’s levels,” he wrote, stressing that the current dip makes the case even stronger.

Inflows Add to the Momentum

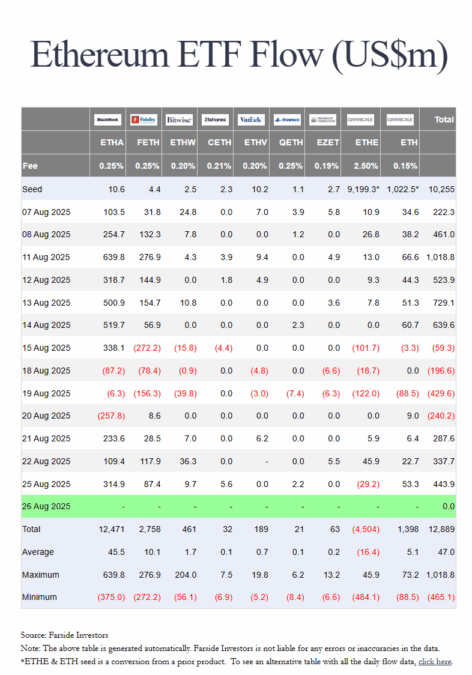

Besides Standard Chartered’s bold projection, market inflows show investors already backing the story. On Monday, ETH-focused funds pulled in $444 million, led by BlackRock’s iShares Ethereum Trust with $315 million, according to Farside Investors.

That followed $338 million on Friday, when Fed Chair Jerome Powell’s dovish comments sparked optimism.

Moreover, ETH funds attracted $628 million across those two days, even as Bitcoin ETFs faced steady outflows, as per Sosovalue.

Ethereum’s 32.6% increase this year far surpasses Bitcoin’s 17.3% gain and is certainly something worth noting. It appears that, based on Standard Chartered’s forecasts, the institutions are increasingly optimistic about ETH this time around.

Notably, the institutions see Ethereum’s recent dip as an opportunity rather than a setback. For investors is a chance to utilise too which does come often.

Also Read: CME Crypto Futures Top $30B as XRP Hits $1B Fastest Ever