The Ripple lawsuit with the U.S. Securities and Exchange Commission (SEC) has finally come to an end after almost five years. The court has approved a joint request from both Ripple and the SEC to dismiss their appeals.

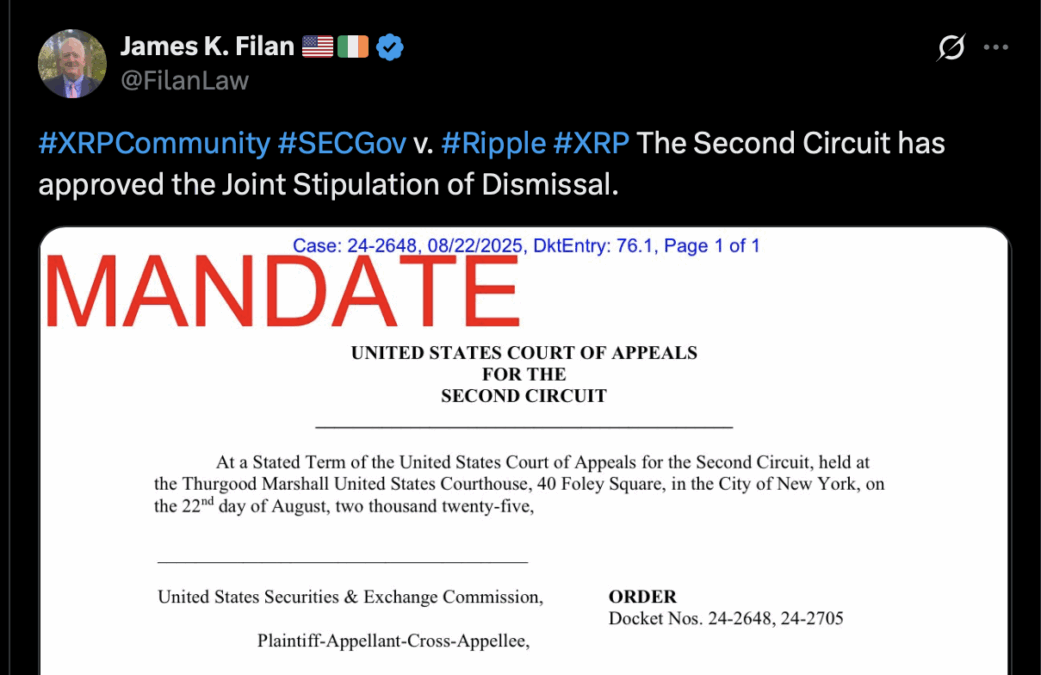

Lawyer James Filan shared the news on X, saying the U.S. Court of Appeals for the Second Circuit signed the order.

The SEC decided to drop its appeal, while Ripple and its executives, Chris Larsen and Brad Garlinghouse, also chose to withdraw their own cross-appeal.

But now that the case is closed, Ripple must pay a penalty to the SEC. Judge Analisa Torres had already ruled that Ripple owed $125 million for breaking securities laws when selling XRP to institutional investors. This fund was already placed in escrow while the case continued, as it waited for the appeal decision to finish.

Earlier, Ripple and the SEC agreed to reduce the penalty to $50 million, but Judge Torres did not accept that amount. She refused to issue a ruling that would change the settlement, leaving the higher fine of $125 million in place. Ripple will now complete this payment to officially settle the matter.

Meanwhile, this is good news to the crypto space and it sure has been celebrated. At the time of writing this report, XRP is up 5.57%. This was from the previous day and intraday low of $2.78. Currently, the token is trading for $3.06, with an 89% surge in trading activity, leading to $9.27 billion in trading volume.

The case initially started back in December 2020, when the SEC accused Ripple of raising $1.3 billion through sales of unregistered securities. Since then, the lawsuit had become a turning point for the crypto space, with debate raising about whether digital tokens should be treated as securities under U.S. law. With the appeals dismissed and the fine confirmed, this chapter is officially closed.

Also Read: Traders Are Shifting to Ethereum as Bitcoin Volatility Drops