SharpLink Gaming, one of the world’s largest corporate holders of Ethereum, announced today a $1.5 billion stock repurchase plan. The move aims to protect shareholder value as its stock trades near levels tied to the net asset value of its ETH holdings.

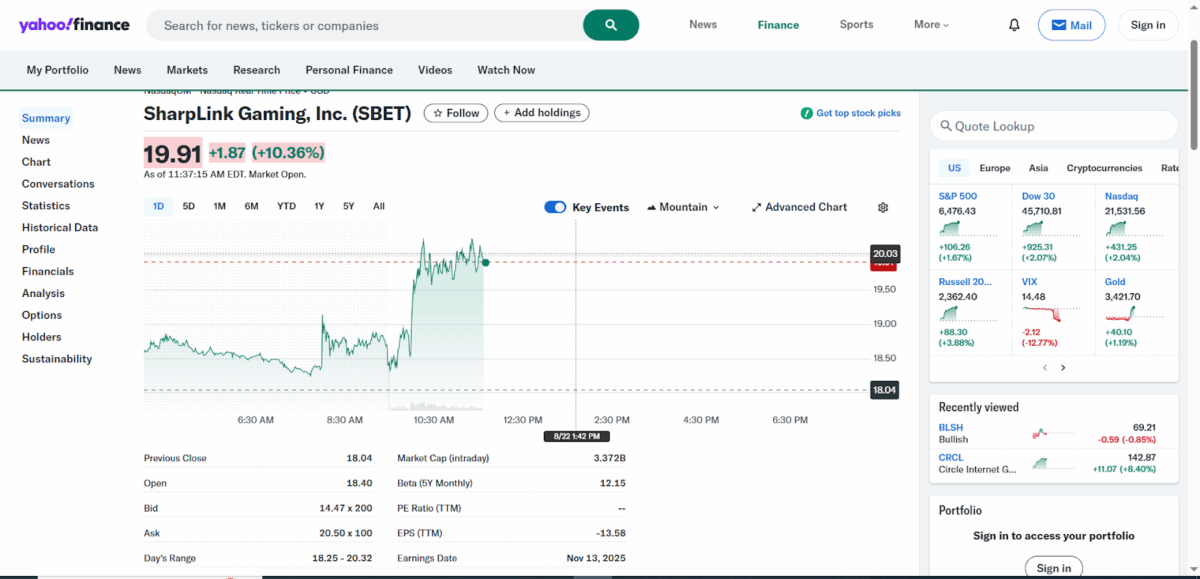

The decision comes as Ethereum trades at $4,304.19, according to coinmarketcap data, while SharpLink’s stock climbed 4.55% to $18.86 as per Yahoo Finance. The board approved the buyback to protect value whenever shares fall below the net asset value of its ETH holdings.

Co-CEO Joseph Chalom emphasized discipline in strategy, stating: “Should there exist periods where our stock trades at or below the net asset value of our ETH holdings, it would be dilutive on an ETH per share basis to issue new equity through our capital raising efforts.” He added that repurchases could provide an accretive path forward.

SharpLink’s Capital Deployment Strategy

The buyback program arrives just days after SharpLink reported ETH acquisitions. Between August 10 and August 17, the company purchased 143,593 ETH at an average price of $4,648.

So far, SharpLink has boosted its total ETH holdings to 740,760, owing to a substantial $536.5 million that was raised via a direct offering and an ATM. Moreover, the management has been actively staking their assets, racking up 1,388 ETH in rewards since June 2.

Apart from these acquisitions, the company has set aside $84 million in cash for future ETH purchases. With the program, it is possible to balance their equity strategy while accumulating more Ethereum.

Balancing Equity and Ethereum Exposure

SharpLink’s leadership made it clear that how they move forward will depend on market conditions. The firm has a variety of options whereby it could buy back shares through the open market, private deals, or any other legal route available.

The plan can be put on hold or simply dropped at any moment. This should, theoretically, put the stock under pressure, which forces any investor to negotiate from the side that holds a flexible plan to grow Ethereum itself.

Looking at SharpLink’s recent ETH purchases, the strategy is straightforward. The company wants to protect shareholder value and, at the same time, grow its Ethereum exposure. The $1.5 billion buyback highlights its serious commitment to both goals.

Also Read: Kraken Boosts Ethereum Staking With SSV Network’s DVT