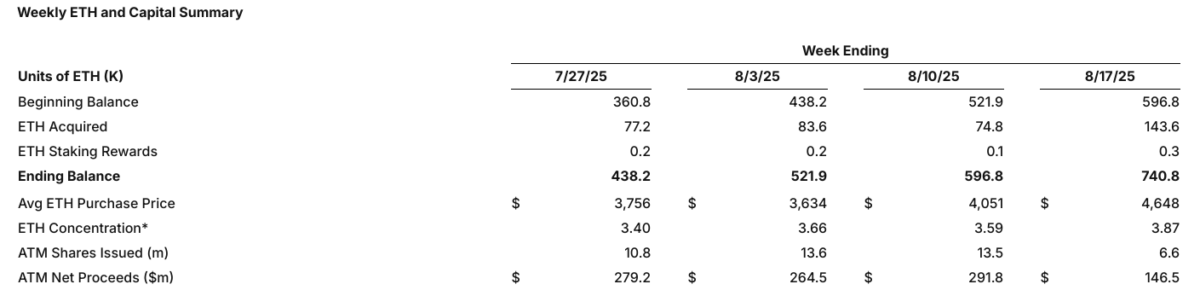

The race to grab more Ethereum is heating up, and SharpLink Gaming has stepped in with a big play. In its latest update, the U.S.-listed company said it bought 143,593 ETH in just one week, ending August 17, 2025.

According to the announcement, the new purchase increases SharpLink’s total Ethereum holdings to 740,760 ETH at an average price of $4,648 per coin. The move cements the firm’s status as one of the largest corporate holders of ETH worldwide.

Besides the massive acquisition, SharpLink raised $537 million through its At-the-Market facility and a registered direct offering. Moreover, the company still holds over $84 million in cash ready for deployment. Hence, SharpLink is a good place to add more to its Ethereum reserves even as market prices fluctuate.

ETH Purchases and Treasury Growth

The company’s weekly summary shows a sharp rise in ETH acquisitions compared to previous weeks. SharpLink added 143,593 ETH, more than doubling its previous week’s purchases.

Since the treasury strategy kicked off on June 2, staking rewards have shot up to 1,388 ETH, which is a boost for acquisitions. However, there’s a bit of a hiccup with a short-term unrealized loss, as the average purchase price of $4,648 is still above the current Ethereum price of $4,282.

Interestingly, ETH concentration—a unique internal metric—has surged by 94% since June, but management doesn’t seem too worried about it. A current concentration of 3.87 indicates accumulation in relation to the number of outstanding shares.

Funding Strengthens Strategy

Furthermore, SharpLink’s funding activities remain a core driver of its expansion. The ATM facility generated $146.5 million in net proceeds last week alone. Meanwhile, the direct offering closed at $390 million, giving the company liquidity to pursue further Ethereum buys.

Additionally, ATM share issuance dropped to 6.6 million, compared to 13.5 million the week before. Hence, the company managed to balance shareholder dilution while raising capital efficiently.

According to Yahoo Finance data, SharpLink’s stock was down 4.08% for the day, trading at $19.30 at 9:45 AM EDT at the time of writing.

This move shows how more companies are now treating Ethereum as a serious treasury asset. And even with the recent price swings, SharpLink’s big Ethereum bet signals that institutional confidence in crypto is growing.

Also Read: MicroStrategy Faces Backlash From Investors Over New Equity Policy