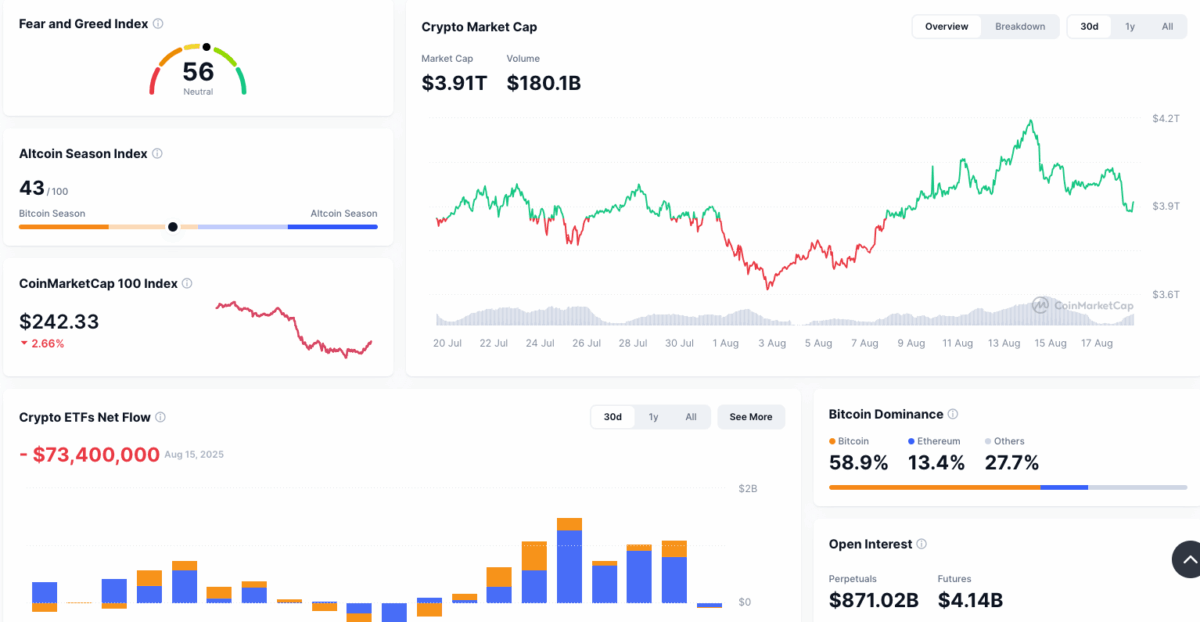

Today, August 18, the global crypto market is feeling the heat as traders face some wild price fluctuations and liquidations. The total market cap has dipped to $3.91 trillion, marking a 2.55% drop in just the last 24 hours.

At the same time, trading activity jumped sharply, with daily volume reaching $178 billion, up more than 52%. Bitcoin, the world’s largest cryptocurrency, dropped 2.12% to trade at $115,698 according to the coinmarketcap.

Market Drivers and Pressures

Bitcoin went through a surge in liquidations after two days of low trading, with $128 million in long positions being unwound—an increase of 1,753%. This wave of leverage unwinding triggered sell-offs across major assets.

Adding to this, profit-taking put pressure on Ethereum after it hit $4,785, pushing its RSI to a heated 87.6. As a result, the pullback shifted the momentum back toward Bitcoin dominance, which now stands at 58.9%.

Moreover, macroeconomic jitters added to the uncertainty. Traders await Fed Chair Jerome Powell’s speech at the Jackson Hole meeting between August 18 and 20. Additionally, capital flows confirmed a risk-off mood, with Crypto ETFs recording $73.4 million in net outflows.

Gainers and Losers in Focus

Despite the broader weakness, a few altcoins recorded gains. Chainlink (LINK) led with a 4.79% rise to $25.71. OKB followed with a 2.9% increase to $120.34, while Monero (XMR) added 2.49% at $271.56. POL, formerly MATIC, rose 1.85% to $0.2505.

It was a tough day for several tokens. Raydium (RAY) took a hit, dropping 8.35% to trade at $3.41. Hyperliquid (HYPE) wasn’t far behind, falling 6.81% to $43.69. Meanwhile, Pi (PI) and Aerodrome Finance (AERO) saw declines of 6.63% and 6.50%, respectively. Interestingly, Hyperliquid also had the highest loser volume, coming in at $209.38 million.

Broader Market Indicators

The Fear and Greed Index is sitting at 56 as of writing, which suggests that the market is neutral. On the other hand, the Altcoin Season Index is at 43, indicating that Bitcoin is still the main attraction.

In addition, the CoinMarketCap 100 Index has taken a slight dip of 2.66%, now resting at $242.33, which hints at some weakness among the top tokens. Open interest remains robust, with $871.02 billion in perpetual contracts and $4.14 billion in futures.

The crypto market is stuck between optimism and caution. While Bitcoin’s dominance and ETF outflows suggest that investors lean towards safety as they wait for favorable macroeconomic signals, some altcoins, like LINK, are still managing to stand out.

Also Read: Weekly Crypto Inflows Soar $3.75B, Ethereum Leads the Pack