DeFi Development Corp, a publicly traded digital asset treasury that has a strong emphasis on Solana, has increased its SOL holdings to an estimated $263 million. The increase came after the company purchased 110,000 SOL tokens for approximately $22 million at an average of $201.68.

In a press release issued Friday, the company said it currently has approximately 1,420,173 SOL and SOL-equivalent assets, counting staking rewards and other on-chain yields. Even after a 4% one-day slide in Solana’s market value to $184 as of midday Friday, the worth of the holdings highlights the magnitude of the company’s spiky accumulation plan.

Previously a real estate technology company named Janover, DeFi Development now serves as a full-time Solana accumulation and staking company. In addition to accumulating SOL for its treasury, the firm also provides staking services to outside investors and earns revenue as Bitcoin mining operations.

As per its recent performance report, the company employs an “Annualized Organic Yield” metric to monitor validator operations returns. Assuming its current holdings, the business projects a 10% AOY that translates to approximately $63,000 worth of daily revenue in SOL terms.

The increase in its SOL position follows closely on the heels of DeFi Development’s closing of a $122.5 million convertible debt offering in July. The notes, which have a 5.5% annual interest rate and a 2030 maturity date, also include a 10% conversion premium to the firm’s July 1, 2025, closing price of $21.01.

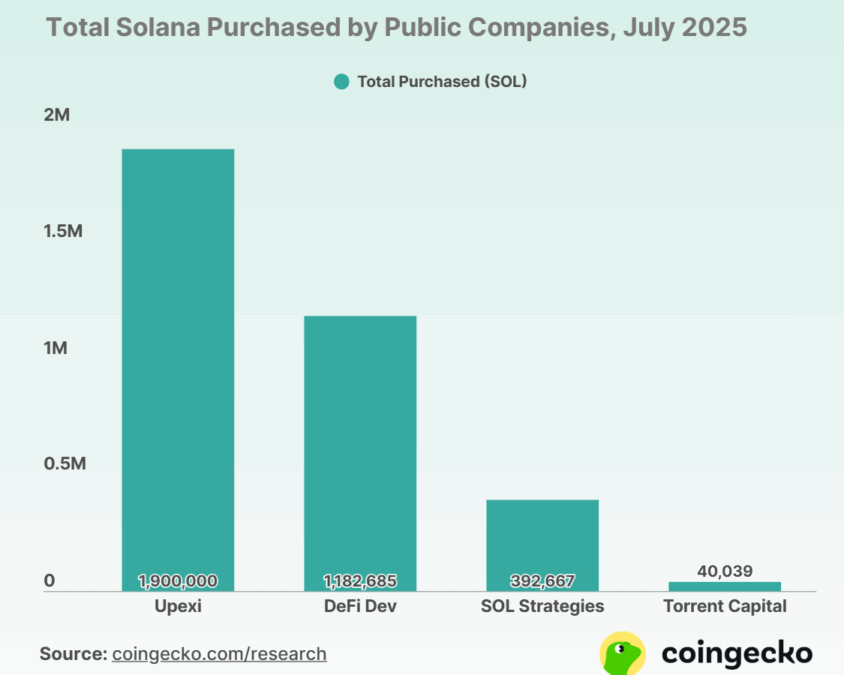

Other public corporations with large SOL holdings include Upexi and Sol Strategies, but DeFi Development’s buying program makes it one of the most assertive corporate purchasers in the Solana space.

Also Read: Solana Crosses $200 as Institutional Buying Sparks Strong Rally