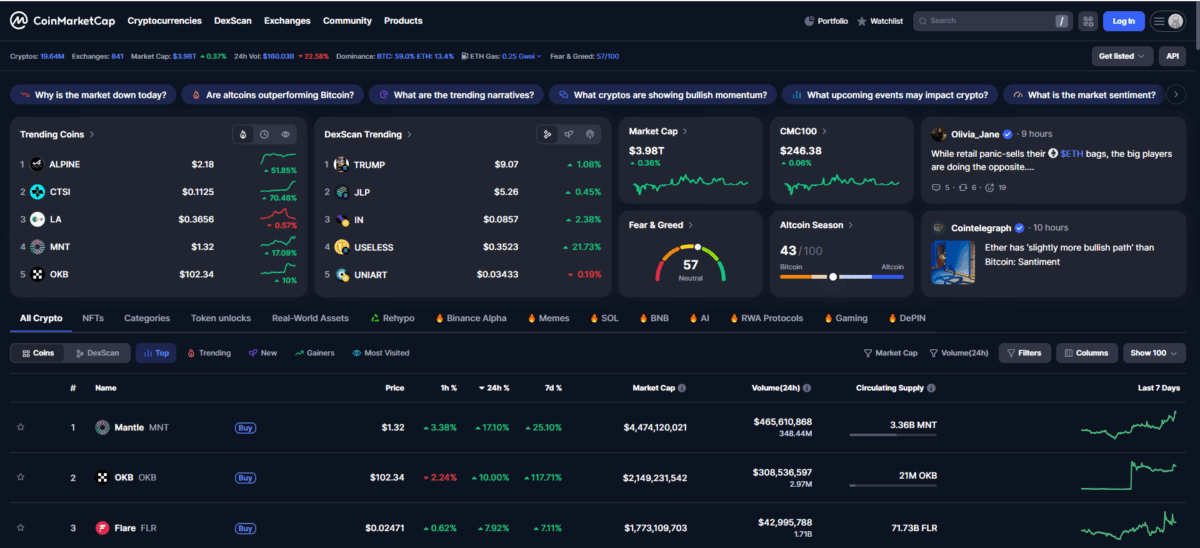

The global crypto market faced selling pressure on August 16 after Bitcoin retreated sharply from its recent peak. The overall market capitalization stood at $3.97 trillion, a 0.82% decline in just 24 hours.

At the same time, trading activity was a bit steady with volumes dipping by 19.78% to $171.63 billion. The leading cryptocurrency, Bitcoin, saw a 24-hour trading volume of $62.94 billion and was priced at $117,737. However, during that same period, the coin experienced a slight drop of 0.32%.

Top Gainers and Losers

Some altcoins had high gains today despite the decline. At the time of writing, Mantle rose 17% to $.32, having $465.6 million in trading volume. OKB followed with a 10.96% rise to $102.2, while Flare climbed 8.64% to $0.02423. The Sandbox also advanced 2.20% to $0.2917.

However, declines dominated the broader market. Pump.fun dropped 8.26% to $0.003391, while Fartcoin lost 6.35% to $0.9519. Arbitrum fell 5.85% to $0.4809 despite recording $570.71 million in volume. Aerodrome Finance slid 5.40% to $1.33, extending losses among altcoins.

Market Sentiment and Indicators

On the market as a whole, the Fear and Greed index stands at 57, with a neutral sentiment in the market. The Altcoin Season Index is currently 43, meaning Bitcoin is still going strong while altcoins are lagging.

Moreover, the CoinMarketCap 100 Index slipped by 0.81% to $245.99, reflecting a general weakening trend in the market. The dominance of Bitcoin stands strong at 59.1%, which is trailed by Ethereum with 13.4%.

Crypto ETFs saw net outflows of $73.4 million an indication of cautious market. Open interest is still quite substantial, hitting $864.12 billion in perpetual contracts and $4.15 billion in futures.

The recent pullback is a result of profit-taking after Bitcoin hit its all-time high of around $124,000.Additionally, there is some ambiguity around the liquidation of derivatives and U.S. Bitcoin reserves, which has increased pressure.

Also Read: Stablecoins Could to Hit $1 Trillion by 2030: Report