TRON is on the move, surpassing 11.1 billion transactions as whale activity surges and price momentum heats up. This record activity has been accompanied by a strong bullish trend for the TRX token, with some analysts now setting a positive price target.

The global crypto market cap is at $4.01 trillion for today, which means there has been 0.04% daily increase, while the whole market volume fell 25.15% to $215.32 billion.

The top cryptocurrency Bitcoin leads at $118,094, up 0.05%, while the coin in focus TRON trades at $0.355304, down 1.22% over the same period according to coinmarketcap.

According to crypto analyst Davide on X, the surge in TRON’s activity is “fueled by record USDT flows as whales moved $700M off Binance in 48hrs.” He added, “TRX has surged over 150% for long-term holders… but RSI signals a potential cooldown before the next leg up.”

Transaction Growth Reflects Strong Network Use

Data from CryptoQuant highlights TRON’s steady transaction growth since 2018. Daily counts now range between 6 million and 9 million, with historic spikes exceeding 12 million in late 2022 and early 2023. The cumulative total is on the rise, showing strong adoption even with a few slowdowns.

Apart from transactions, the movements of big investors suggest that institutional interest is on the rise, but this concentration also brings risks of increased volatility.

Technical Indicators Show Caution Despite Bullish Channel

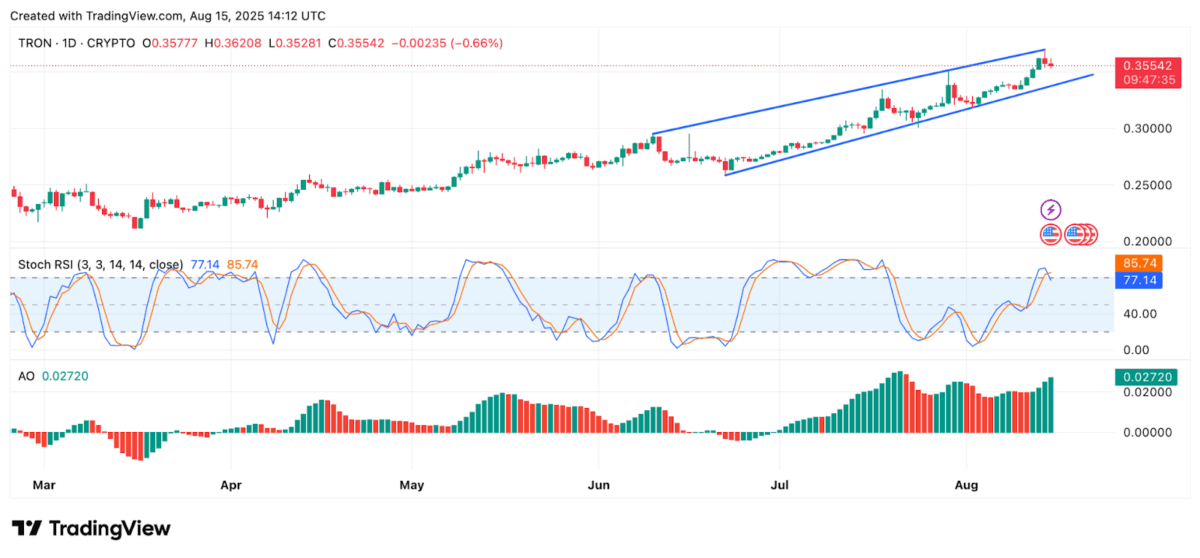

According to data from TradingView, TRON has been on an upward trend since mid-June. As per the chart, the token is priced at $0.35542, which is a slight daily dip of 0.66%.

Stochastic RSI readings of 77.14 and 85.74 in the overbought territory signify a possible short-term pullback. While momentum could see a dip before another spike, this still reflects strong buying action. The Awesome Oscillator is also in positive territory, indicating ongoing buying pressure since July.

The strong fundamentals, active network utilization, and whale-driven liquidity supports a long-term positive outlook, even when elevated RSI levels indicate the need for prudence. TRON may challenge higher resistance levels if the trend continues.

Also Read: ETH Spot ETFs Poised for Record Week as Inflows Top $2.9 Billion