Standard Chartered has raised its year-end 2025 price target for Ethereum (ETH) to $7,500 from a previous forecast of $4,000. The bank’s positive outlook is based on record inflows in ETFs, treasury demand, and rampant adoption of stablecoins.

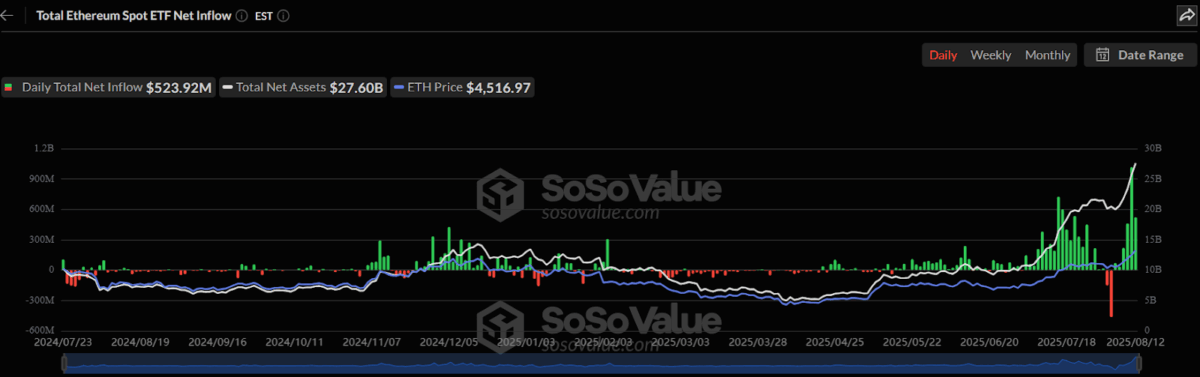

In its research, the bank wrote Ether treasury businesses and ETFs have acquired 3.8% of the circulating ETH supply since June 1, nearly double the fastest Bitcoin accumulation rate observed throughout the 2024 U.S. election cycle. This demand shock has been a primary catalyst for the recent price rally.

ETH ETFs just logged over $1 billion inflows, the highest since they launched in the U.S., driving the token to within 4% of its November 2021 all-time high of $4,891.

The bull upgrade comes as network activity increases after the July passage of the GENIUS Act, which established a clear U.S. regulatory environment for stablecoins.

Standard Chartered estimates the stablecoin market will grow eightfold to $2 trillion by 2028 with Ethereum, which hosts more than half of all stablecoin issuance, taking most of that growth. Stablecoins currently support 40% of all blockchain fees, giving ETH consistent demand.

Technical improvements are in the works as well. Ethereum co-founder Vitalik Buterin will boost layer-1 throughput by 10x to support more high-value on-chain transactions and push lower-value transfers onto layer-2 solutions such as Arbitrum and Base.

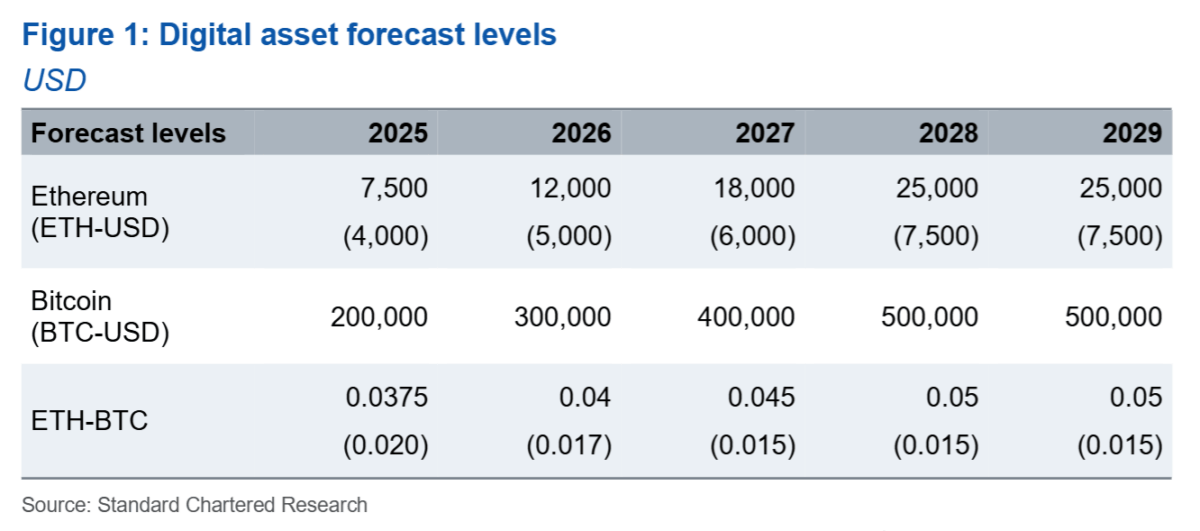

The third-largest cryptocurrency is expected by the bank to outperform Bitcoin in the next twelve months, with the ETH-BTC rate to rise from 0.036 to 0.05 by the end of 2025. The long-term target now are:

- $7,500 by year-end 2025 (up from $4,000)

- $12,000 by year-end 2026 (up from $5,000)

- $18,000 by year-end 2027 (up from $6,000)

- $25,000 by year-end 2028 (up from $7,500)

At the time of writing, ETH was trading at around $4,692, up more than 50% in the past month.

Also Read: ETH Eyes Breaking to New All-Time High Amid Strong Institutional Push

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Crypto asset investments carry significant regulatory risk and are not suitable for all jurisdictions.