Crypto traders woke up to a shock on Thursday as Bitcoin’s record-breaking climb came to a sudden stop. The world’s biggest cryptocurrency, which had just smashed past $124,000 for the first time, suddenly reversed course.

The recent surge coincided with Ether reaching $4,791.19, just a hair below its all-time high from 2021. But then, unexpectedly high U.S. wholesale inflation data reversed gains, causing a swift pullback.

As of now, Bitcoin has dipped 1.72% to $118,243, with a 24-hour trading volume of $108.89 billion, according to CoinMarketCap. Meanwhile, Ether has also taken a hit, sliding down 2% to $4,591.40.

The rally began Tuesday after a cooler consumer inflation report boosted hopes for Federal Reserve rate cuts in September. Consequently, both Bitcoin and Ether rallied with stocks, with the S&P 500 and Nasdaq reaching new records. However, the fresh inflation numbers dampened optimism and encouraged profit-taking.

Technical Patterns Indicate Short-Term Weakness

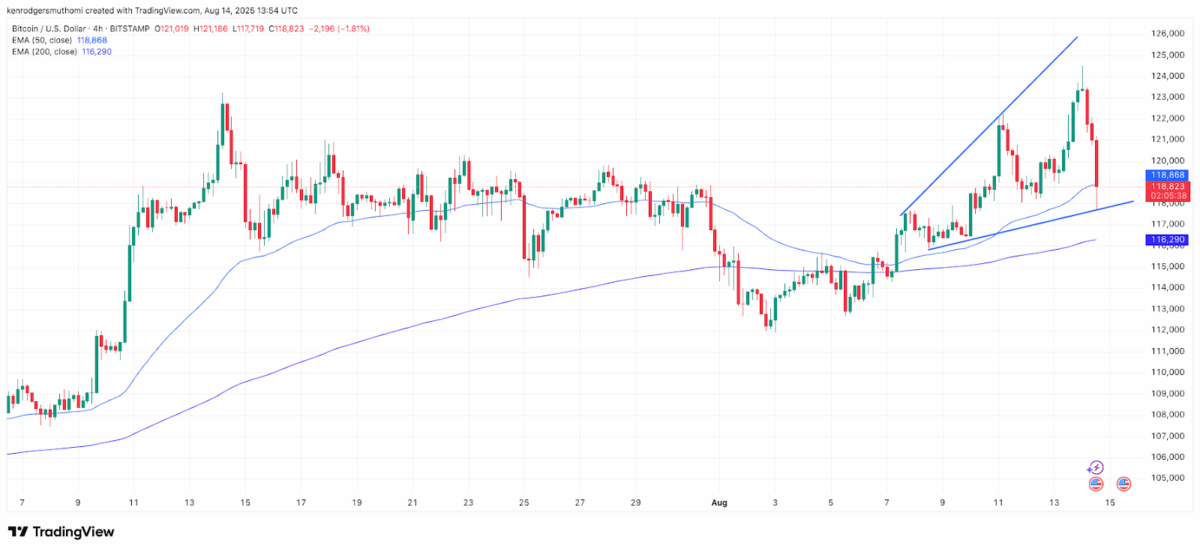

TradingView’s four-hour chart reveals that Bitcoin was on a strong upward trajectory until August 13, when it peaked at around $121,000 before losing steam. After that, prices broke through the upward trend line and dipped below the 50-period moving average.

The 50-day average is above the 200-day average, which means that there was some short-term optimism in the market not so very long ago. But with the recent drop, it looks like the sellers are in control again.

Moreover, the growing distance between Bitcoin’s price and the 50-day average indicates that there may be increased volatility soon.

According to Coinglass data, over $1 billion in positions were liquidated in just the past 24 hours, with long positions taking the biggest hit, losing $782 million and impacting more than 219,000 traders. The largest single liquidation occurred on Bybit’s BTCUSD contract, totaling a staggering $10 million.

Market Sentiment Moving Forward

When looking at the medium-term outlook, medium-term sentiment is still positive. This is due to institutional interest and the trend of adoption, despite short-term bumps along the way.

Bitcoin’s recent surge to a new all-time high quickly turned into a pullback, largely due to inflation worries shaking up the markets. While the whole trend is promising, volatility may around in the upcoming sessions.

Also Read: Bitcoin Price Surges Past $123K as Rally Targets $125K