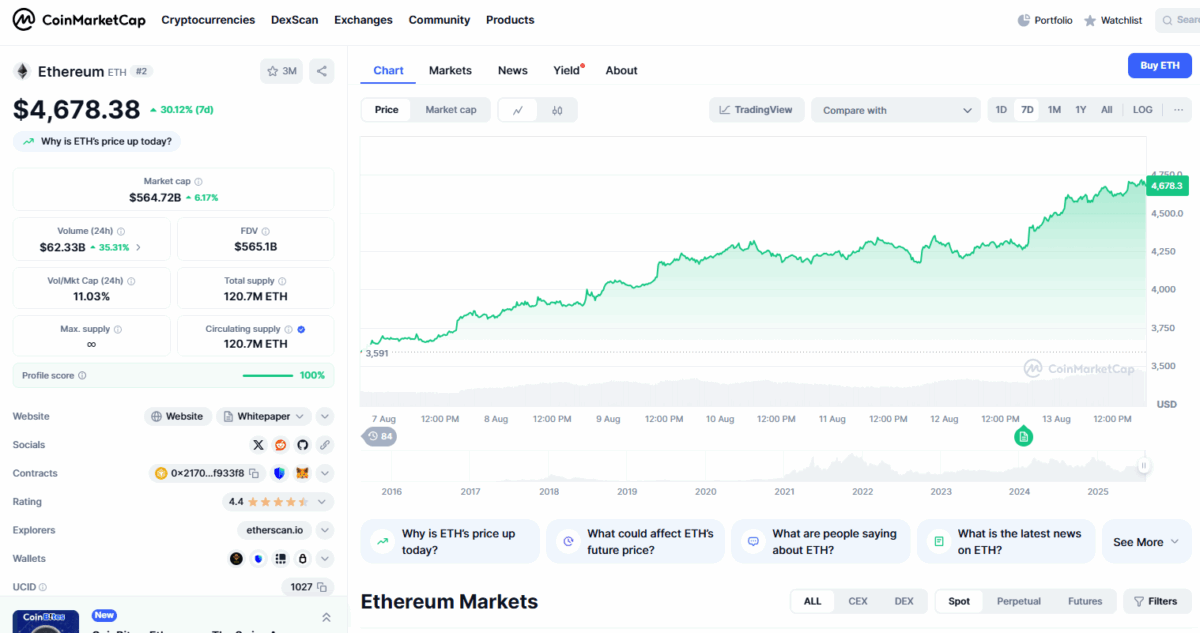

Ethereum (ETH) is moving closer to a new all-time high (ATH) after strong buying from large investors and rising demand through exchange-traded funds (ETFs). ETH currently trades above $4675, as per CoinMarketCap, which is less than 6% away from its all-time high of $4891. The price has climbed about 6.62% in the past 24 hours.

As of today, since the Asian trading session began, ETH already hit a daily high of $4734.45, trading volume has also surged 25% as it soared past $61.58 billion. With all this bullish sentiment breaking the ATH seems easy as it’s only $200 away.

ETH has grown strong to become an institutional digital asset with more firms adopting its solution. This has been a major driver of the performance in the last few days.

BitMine Immersion Technologies, one of the ETH treasury firms, has filed with U.S. regulators to lift its share offering to $24.5 billion. The company says it will use the funds to buy more Ethereum. It already holds more than one million ETH and aims to own around 5% of the total supply. This approach is taking a large amount of Ethereum out of the market.

SharpLink Gaming has also moved to increase its ETH holdings, raising almost $400 million for fresh purchases. These large treasury buys are adding to the market’s upward push.

ETH Spot ETF Demand Grows

Ethereum spot ETFs have pulled in record amounts of inflow in recent days. Data from SoSoValue shows $1.02 billion came in two days ago. BlackRock’s ETHA fund led with about $640 million, followed by Fidelity’s FETH at $277 million. Over the past week, total ETF inflows have reached more than $2.3 billion. Funds now hold about $27.6 billion worth of ETH which is 4.77% of Ethereum’s market cap.

“Spot ETH ETFs have pulled in about $2.3 billion over the last five trading days, including one of their top five single-day intakes since launch. Since early July, they’ve attracted roughly $1.5 billion more than spot Bitcoin ETFs,” said Nate Geraci, President of The ETF Store.

The price of ETH is now up more than 40% this month after a slow start to the year. A boost has also come from the passing of the GENIUS Act in the U.S., which has set clearer rules for stablecoins. Many leading stablecoins operate on Ethereum, so the new law could support higher use of its network.

Crypto analyst Michael van de Poppe said on X that Ethereum is showing strength similar to the rally that followed Bitcoin ETF approvals earlier this year. He added that if the current buying trend holds, ETH could test its record price soon.

Also Read: Nasdaq Listed BTCS Inc. Adds Pudgy Penguins NFTs to Treasury