Ethereum is closing in on a key price target of $4811 as U.S. inflation data initiates a market surge and record ETF inflows. The Consumer Price Index rose 2.7% in July year-over-year, compared to the 2.8% forecast.

According to a new U.S. Bureau of Labor Statistics (BLS) report, this reading increased the odds of a September Federal Reserve rate cut to 82.5% leading to demand for cryptocurrencies. As of writing, Ethereum traded at $4,409.12, up 5.4% in the past 24 hours, with trading volumes topping $47.9 billion.

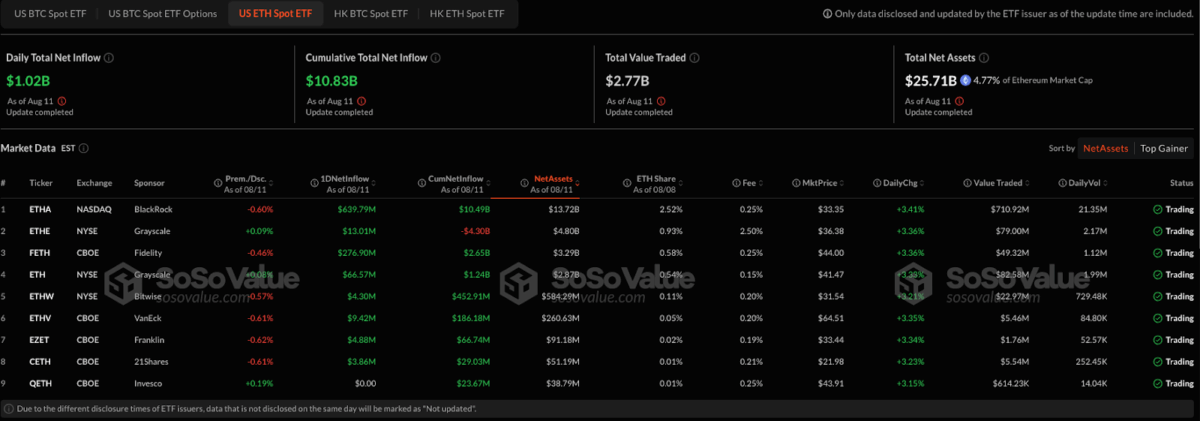

Besides the macro boost, U.S. spot Ethereum ETFs recorded massive inflows. On August 12, they attracted over $1 billion, led by BlackRock’s ETHA with a single-day record of $639 million.

Consequently, total ETH ETF assets under management reached $19.2 billion, a 58% monthly surge. As of August 11, Sosovalue data shows U.S. spot ETH ETFs holding $25.71 billion in net assets, 4.77% of Ethereum’s total market cap.

Technical Momentum Builds

According to Crypto analyst Javon Marks, Ethereum has rallied nearly 261% since breaking a long-term resistance trend. The cryptocurrency has moved past $4,400 and is targeting $4,811.71, just under 10% higher as per the analysis.

The chart indicates that there was a recovery from a prolonged 2022-2023 downtrend, with prices pushing through resistance levels in 2024 before the breakout happened.

However, Ethereum now trades more than 8.9 million units every day. As shown by Sosovalue, ETF products like FETH have also experienced notable activity, with 2.79 million traded in just one day. The fee structures are quite competitive, ranging from 0.25% to 2.50%.

Market Risks Emerge

The rally seems to have caught the attention of hackers. According to the on-chain tracker Spot On Chain, the Infini Exploiter managed to sell off 1,771 ETH for $7.44 million in DAI at a price of $4,202.

Meanwhile, the Radiant Capital Exploiter liquidated 3,091 ETH, raking in $13.26 million in DAI at $4,291. Both of these groups still have a hefty stash of stolen ETH in their possession.

Ethereum is rising, thanks to favorable macroeconomic conditions and a strong interest from institutions through ETFs. The technical indicators suggest there could be more gains to be expected, possibly reaching $4,811. However, large-scale hacker liquidations might bring some volatility into the mix.

Also Read: U.S. Spot Ethereum ETFs Hit $1 Billion Daily Inflows for First Time