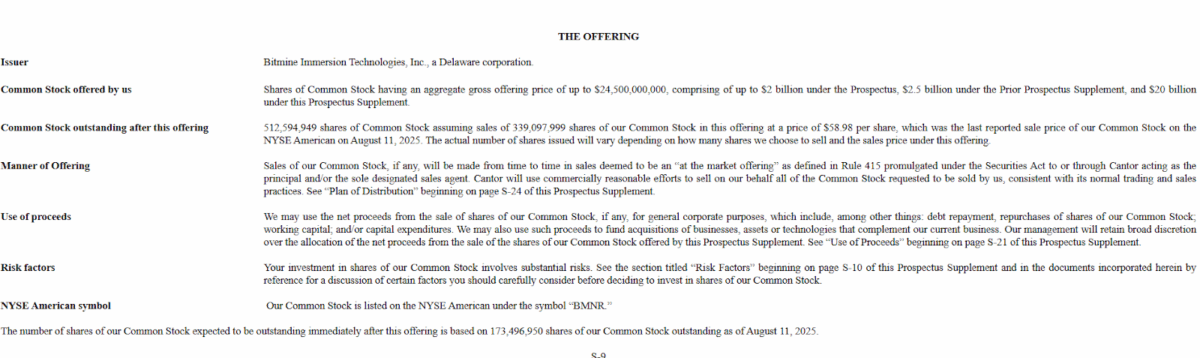

Bitmine Immersion Technologies (NYSE American: BMNR) is planning to raise up to $20 billion in an expanded at-the-market (ATM) offering, proceeds of which will be used in part to bolster its Ethereum (ETH) reserves, as per a new SEC filing.

The firm registered a prospectus supplement on August 11 revising its July 2025 offering plan, increasing the amount of common stock that can be sold under its Controlled Equity Offering Sales Agreement with ThinkEquity and Cantor Fitzgerald.

Bitmine may now sell $24.5 billion in stock under the updated plan $2 billion from the initial prospectus, $2.5 billion from a July 24 supplement, and another $20 billion from the most recent filing.

Before the upgrade, Bitmine had already disposed of approximately $4.5 billion of the shares under the old authorization, so it has approximately $723 million of that allocation remaining as well as this new $20 billion capacity.

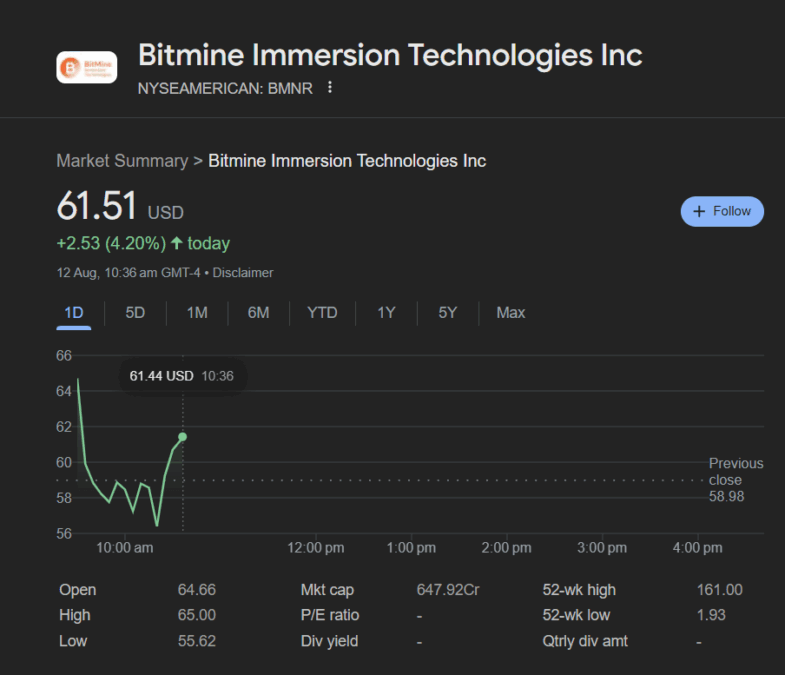

BMNR shares closed on Monday at $58.98. The ATM structure will enable Bitmine to sell stock over time into the market at prevailing prices, through exchanges like the NYSE American or negotiated transactions.

Cantor Fitzgerald and ThinkEquity will serve as sales agents, earning up to 3% in commissions on gross proceeds.

Bitmine has become a leader in blockchain infrastructure and immersion mining high-efficiency technology.The company has recently announced that its plan is to diversify its cryptocurrency positions beyond simple mining rewards.

It is investing some of its capital buying ETH to position itself ahead of network upgrades and to support other activity in decentralized finance.

If it does receive the entire amount, the $20 billion boost would be one of the largest equity financings in the crypto universe.

This would give Bitmine significant power to expand its operations, stockpile more ETH, and become a more formidable force in the digital assets sector.

Also Read: BitMine Builds World’s Largest ETH Treasury in 35 Days