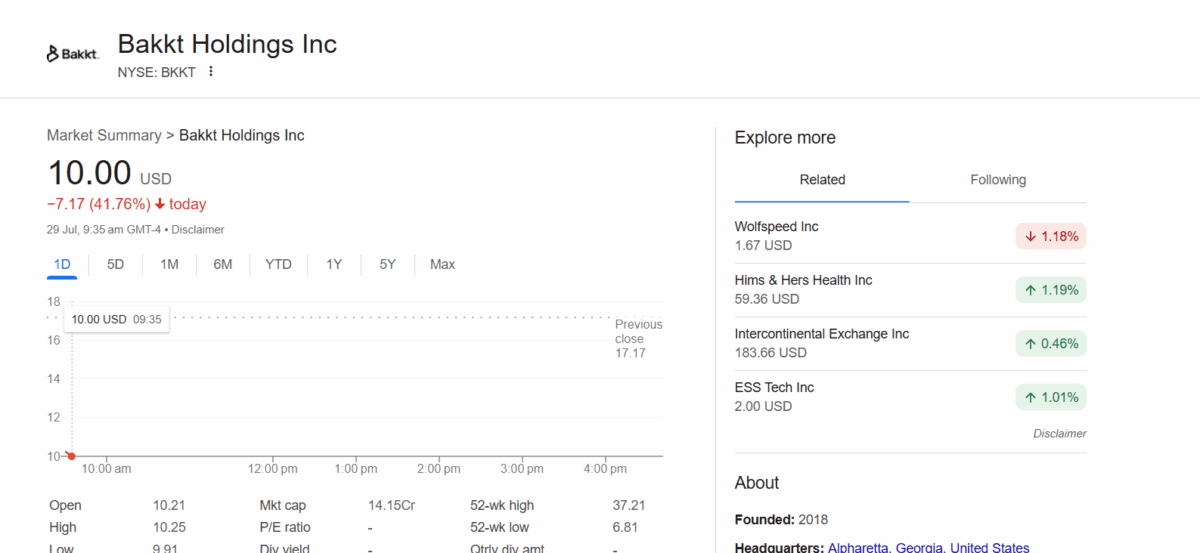

Bakkt Holdings Inc. fell by over 40% in Tuesday morning trading following the announcement late Monday that it would price a $75 million public offering. The digital asset platform disclosed its plans to issue 6.75 million of its shares of Class A common stock at $10.00 a share far off Monday’s close at $17.17.

In addition to common stock, Bakkt is selling pre-funded warrants for up to 746,373 shares at $9.9999 per share. The offering is expected to close on July 30, pending customary closing conditions. The sharp drop reflects investor concern about the deep discount and dilution of existing shares.

The company plans to deploy the funds in general corporate purposes, including working capital and buying digital assets. This is a sequel to Bakkt’s recent change of strategy in which it is looking to become a pure-play crypto infrastructure company.

In its previous announcement, the company made a new policy of investment where it can invest the capital in Bitcoin and other digital assets as per its treasury policy.

Filings with the U.S. Securities and Exchange Commission indicate that Bakkt would raise as much as $1 billion in equity and debt offerings to fund its approach of buying cryptocurrency. Considering this very aggressive capital raising strategy, Bakkt has not yet finished a single real acquisition of digital assets.

The sale is being led by Clear Street and Cohen & Company Capital Markets as joint book-running managers. Bakkt has also granted underwriters an option to purchase up to 1.13 million additional shares or pre-funded warrants at the offering price, less fees, over a 30-day period.

Founded in 2018, Bakkt has focused on crypto custody, trading, and reward services. It is among a few firms that are utilizing traditional capital markets to build treasuries in crypto assets with the aim of gaining strategic access to leading assets like Bitcoin, Ethereum, and Solana.

Also Read: Hong Kong Monetary Authority Implements Stablecoin Licensing Framework