Bitcoin price jumped to a high of 119,700, surprising traders with a weekend rally as trading volumes increased. The sharp increase is attributed to the fact that reports point to the possibility of a 90-day extension of the tariff truce between the U.S. and China.

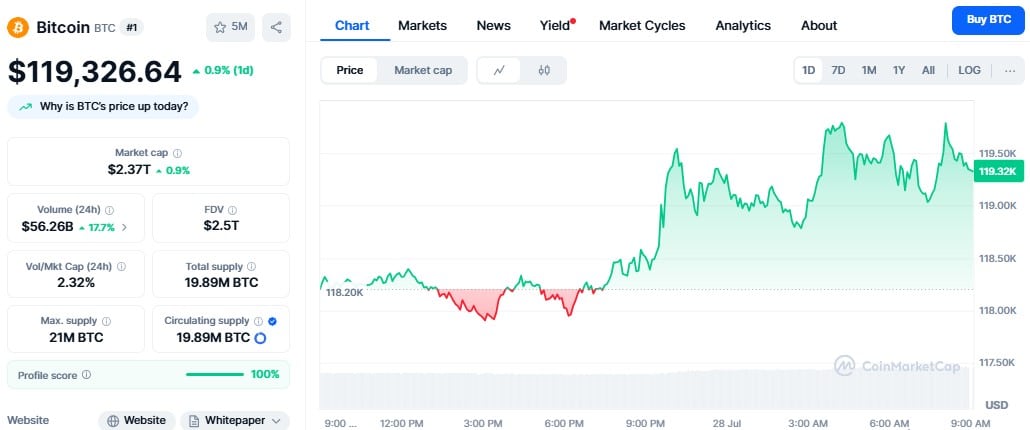

According to CoinMarketCap, Bitcoin is up nearly 1% in the past 24 hours, now trading at $119,326. Daily trading volume surged 17% to $56 billion, and the price momentum remains strong. Bitcoin is only 2.88% off its all-time high of $123,091, which was registered on July 13.

Fueling the rally is news of renewed optimism in the trade talks between the U.S. and China. As per the South China Morning Post, both countries plan to meet in Stockholm to finalize an agreement that would freeze tariffs for another 90 days. This pause could help ease global market tensions, giving risk assets like crypto room to climb.

Adding to the bullish sentiment, MicroStrategy (Strategy) issued a Bitcoin buy signal early Sunday, which appears to have triggered more institutional interest. Bitcoin’s hashrate also reached a record 932 EH/s, with difficulty sitting at 127.62T.

The rally isn’t limited to Bitcoin. Ethereum crossed $3,825, and CME futures for ETH hit a record $7.85 billion in open interest. BNB hit a new all-time high of $825. The total crypto market cap is now $3.94 trillion, just shy of the $4 trillion milestone as Bitcoin continues to lead the charge.

Also Read: Citi Analyst Predicts Bitcoin Could Surge to $199K by Year-End