TON Foundation and Kingsway Capital Partners plan to raise $400 million to launch a public company holding Toncoin as its primary treasury asset. The initiative follows the MicroStrategy model of building institutional crypto exposure through public equity markets.

The company will raise capital through a Private Investment in Public Equity (PIPE) transaction, where institutional investors purchase public shares at a discount, according to Bloomberg. The funds will purchase Toncoin (TON), the native token of the Telegram Open Network blockchain.

Structure and Leadership of New Firm

The new entity may utilize a Special Purpose Acquisition Company (SPAC) structure to go public, mirroring other crypto treasury firms. MicroStrategy’s stock surged 3,400% over five years by holding Bitcoin on its balance sheet, establishing the template for crypto treasury companies.

Kingsway Capital, led by Manuel Stotz, is expected to be one of the investors in the new company. Stotz is also the president of the TON Foundation, which has been working to expand the use of its blockchain platform, especially in the United States.

Cohen & Co. is reportedly advising on the formation of the new company. Cohen had earlier worked on a $1.5 billion deal involving a company focused on Ethereum. Cantor Fitzgerald, known for supporting similar crypto treasury companies, has also shown interest in Toncoin-related ventures, Bloomberg said.

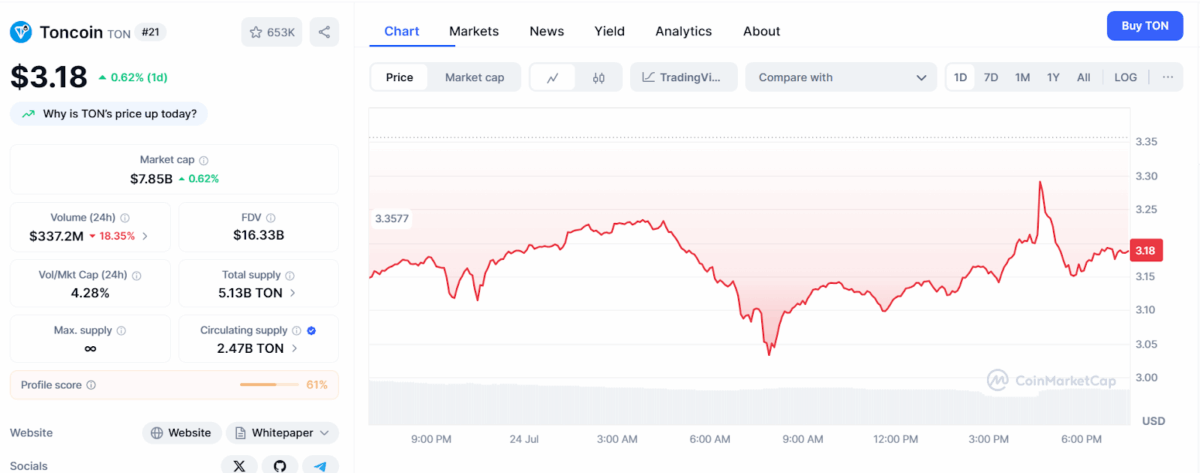

Meanwhile, Toncoin’s price rose nearly 2% following the announcement before retreating to 0.8% gains. It is currently trading at $3.18, with a total market value of around $7.68 billion. However, its trading volume dropped 18% in 24 hours, as the crypto market faced pressure from Ethereum-related uncertainty.

Toncoin, which was originally created by the founders of Telegram, now operates independently but still reacts to news involving the app and its CEO, Pavel Durov. According to CoinMarketCap, the token is currently ranked in the top 24 cryptocurrencies.

But despite all this attention, Toncoin’s price has dropped about 54% since the beginning of the year. Meanwhile, Bitcoin has risen around 25% over the same period.

TON Foundation Controversies

The TON Foundation faced criticism earlier in 2025 after promoting a UAE Golden Visa program tied to Toncoin staking, which UAE officials later discredited, according to regional media reports. The organization has since clarified its position on such partnerships.

The crypto treasury company model continues gaining institutional traction as firms seek to replicate Bitcoin-focused success stories. The Toncoin initiative represents the latest attempt to apply this strategy to alternative cryptocurrencies beyond Bitcoin and Ethereum.

Current PIPE market conditions show institutional appetite for crypto exposure through public equity structures, though regulatory requirements vary significantly across jurisdictions.

Also Read: Story IP Soars 76% In July, Will IP Price Hit $6.4 This Week?