Ethereum spot ETFs pulled in over $726 million daily net inflow on Wednesday, a surge from the previous day’s $192 million. This is the highest daily inflow so far and has helped push ETH’s price to $3,400, an over 9% gain in a single day.

As per marker data, BlackRock’s iShares Ethereum Trust (ETHA) bought the highest chunk of the daily inflow, receiving $489 million in net inflows. The fund also saw $1.8 billion in trading volume, the highest since its launch in July 2024.

Fidelity’s FETH brought in $113 million, its strongest single-day performance since December 2024. Grayscale’s mini Ethereum Trust (ETHE) followed with $54 million, the highest since November. The total daily inflow for all Ethereum spot ETFs reached $726.74 million, as per SoSoValue data.

U.S. spot ETH ETFs now hold around 5 million ETH, worth approximately $17 billion with the current ETH USD price. This also equals about 4% of the total ETH supply.

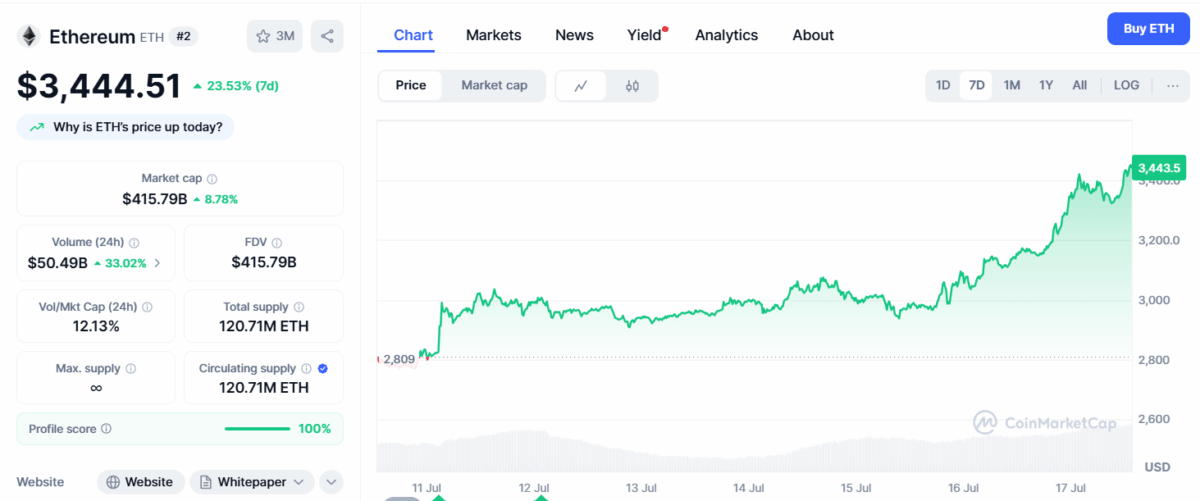

At the time of writing, ETH price is up nearly 24%, reaching a multi-month high of $3,460, its highest since January. Over the past two weeks, ETH has risen about 30%, outperforming Bitcoin’s 8.5% rise during the same period.

Besides, the institutional demand for ETH has also gone beyond ETFs with data from strategic ETH Reserve showing that big firms now hold 1.6 million ETH in their treasuries, worth roughly $5.5 billion. These firms are buying ETH 36 times faster than it is produced. In addition, ETH-based investment products saw $990 million in inflows this week, marking 12 straight weeks of gains.

Also Read: US Marshals Service Confirms $3.45 Billion in Bitcoin Holdings