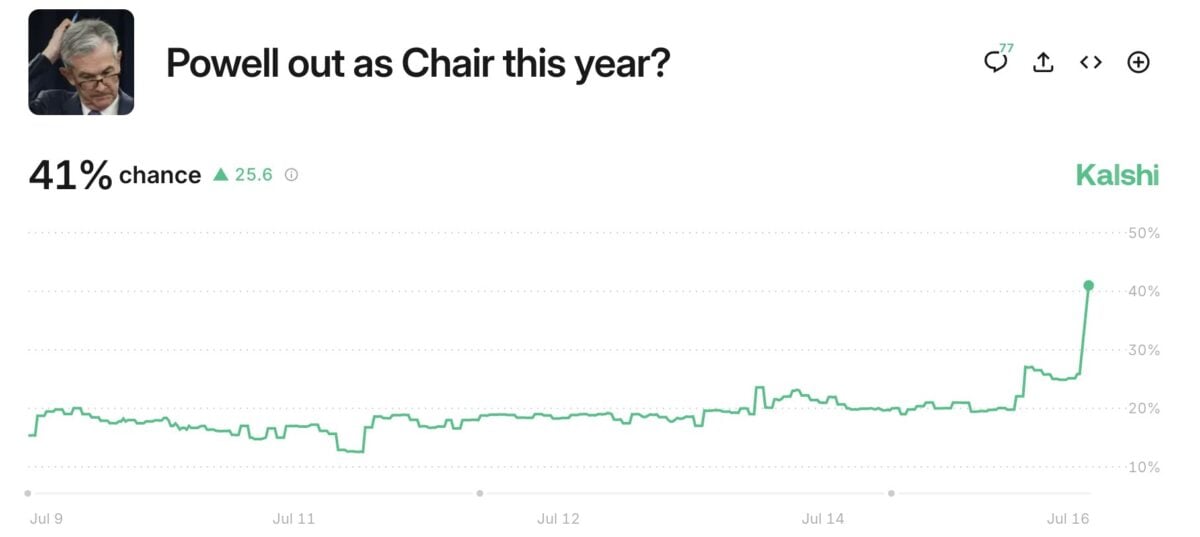

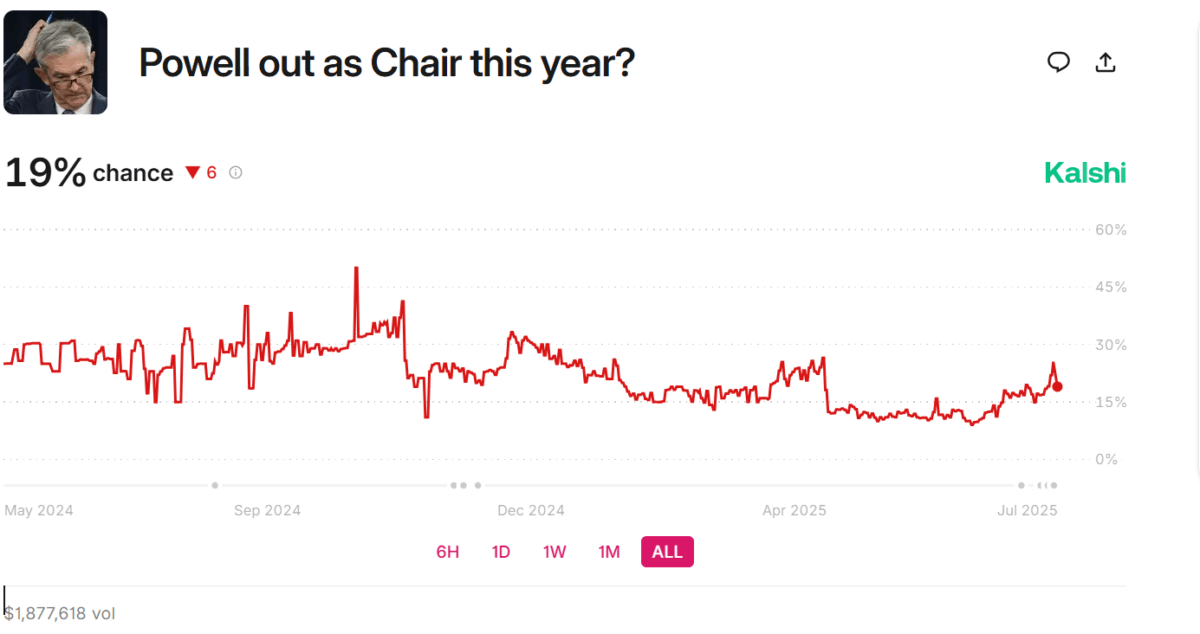

The chances of Federal Reserve Chair Jerome Powell being fired this year spiked to 42%, according to betting market Kalshi. But just a few hours later, those odds dropped to 19% after President Donald Trump said he is not planning to fire Powell.

This came just hours after Bloomberg reported that Trump was likely to fire Powell soon. The report quoted a source from the White House but did not name the person.

Later, CBS News reported that Trump asked Republican lawmakers during a Tuesday night meeting in the Oval Office whether he should fire Powell. Several people in the room said Trump gave the impression that he would go through with it. The meeting took place at the White House and included members of the House of Representatives.

In a separate report from Reuters, Trump was reportedly open to the idea of firing Powell and received positive feedback from lawmakers. A source told Reuters that Trump had not made up his mind but was leaning in that direction.

However, Reuters gave new reports today that Trump told reporters that he had no current plans to fire Powell, which calmed down the markets. This is because the majority of stocks had dipped due to the initial report. The U.S. dollar had dropped, and Treasury yields had gone up earlier in the day when the first reports came out.

The crypto community is also keenly observing these developments. A sudden change in the Federal Reserve’s leadership can potentially influence bitcoin and the rest of the crypto market. While it may not change the course of Bitcoin price in the long run, stability or instability in the traditional market often has short-term ripple effects on digital assets.

Meanwhile, Trump has nonstop criticized the Fed in recent months for not cutting interest rates. He has also called on Powell to resign, but the president does not have the legal authority to fire the Fed chair over policy disagreements. Powell has said publicly that he intends to serve out his full term, which ends on May 15, 2026.

Powell was first nominated by Trump in 2017 and later reappointed by President Joe Biden. Despite their policy differences, Powell has remained firm on keeping rates steady amid inflation concerns.

Last week, the White House increased pressure on Powell when Russell Vought, Director of the Office of Management and Budget, sent him a letter criticizing a $2.5 billion renovation of the Fed’s headquarters. Vought said Trump was “extremely troubled” by the cost overruns.

Also Read: Trump’s Memecoin Token Unlock Adds $93M to His Wealth