JPMorgan Chase CEO Jamie Dimon has said repeatedly he’s still leery of stablecoins but that won’t prevent his bank from taking a bet. In comments on the company’s recent earnings call, Dimon admitted that even though he’s cautious, JPMorgan will press on with testing stablecoin and deposit coin offerings to remain competitive in the changing digital payments landscape.

We’re going to be doing both JPMorgan deposit coin and stablecoins so that we can learn it, so that we can be proficient at it,” Dimon said. “I do believe they’re real, but I don’t know why you’d want to [use a] stablecoin as opposed to just payment.

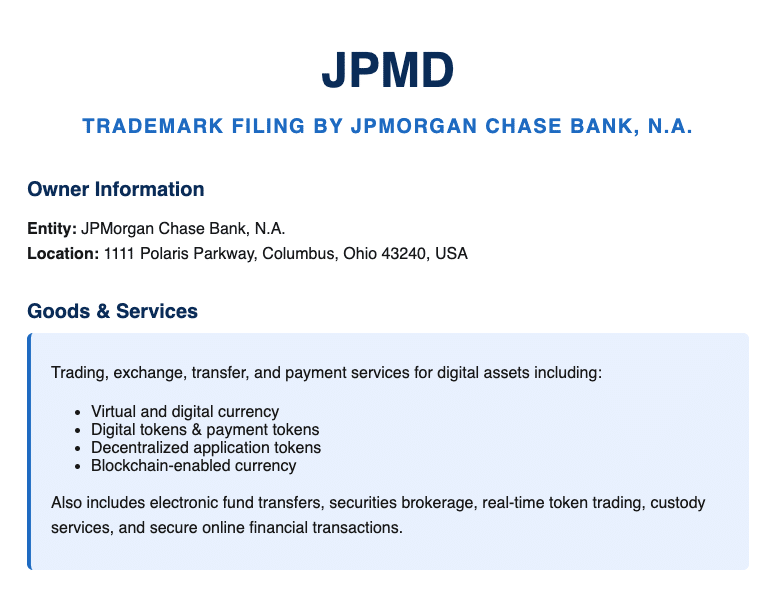

JPMorgan recently announced it will introduce a limited stablecoin that is custom built for its customers, but not for public consumption. While Dimon remains skeptical about the necessity of stablecoins in relation to traditional payment networks, he stressed the value of being active to maintain the pace of fintech developments.

“You see, these folks are real smart,” he explained, talking about fintech rivals. “They’re working to get inside bank accounts, to get into the payment systems and rewards platforms, and we need to be aware of that. And how you become aware is by being part of it.”

Stablecoins digital currencies usually anchored to the U.S. dollar have attracted growing attention from the legacy financial industry. They hold a potential advantage in terms of speed and expense of transactions over older banking networks such as ACH or SWIFT.

Dimon’s comments imply that the advantages are not yet sufficient to outweigh the disadvantages in his opinion, but JPMorgan is following very closely as it would not want to be left behind.

Other banking giants are showing similar intent. Citigroup executives said they are evaluating the issuance of a Citi stablecoin. Bank of America CEO Brian Moynihan also confirmed interest in the stablecoin space.

When asked whether large banks might collaborate, possibly similar to how they created Zelle Dimon left the door open: “That’s a great question, and we’ll leave it remaining as a question.”

Also Read: US DOJ and CFTC Drop Polymarket Case in Pro-Crypto Trump Era