U.S. spot Bitcoin exchange-traded funds (ETF) recorded the ninth consecutive day of net inflows on Tuesday, attracting a total of $403 million.

As per reports, the largest source of inflows is the iShares Bitcoin Trust (IBIT) operated by BlackRock, which absorbed a massive amount of $416.35 million. VanEck Bitcoin Trust (HODL) followed with a net positive flow of $19 million, and other Grayscale Mini Bitcoin Trust and Bitwise BTBT had slight inflows as well.

The gains were, however, dampened by redemptions in three funds. Grayscale Bitcoin Trust (GBTC) saw outdescribe of $41.22 million, whilst Fidelity Bitcoin Trust (FBTC) recorded $23 million in outflows. ARKB saw net outflows of $6.21 million.

Besides these redemptions, the total new inflow into the spot Bitcoin ETFs is now at $53.07 billion. Within the recent nine trading sessions alone, the funds have received new capital of $4.4 billion. Inflows comprehensively about $17 billion have been recorded since April, resulting in continued interest due to institutional investors.

Min Jung, a research analyst at Presto Research said that the inflows into bitcoin ETF have been up since April, as increasingly more institutional investors and corporate treasuries adopt bitcoin. This constant demand has only solidified the niche of Bitcoin within the digital asset marketplace. In the interim, spot Ethereum ETFs also recorded their eighth straight in terms of net inflows at $192.33 million.

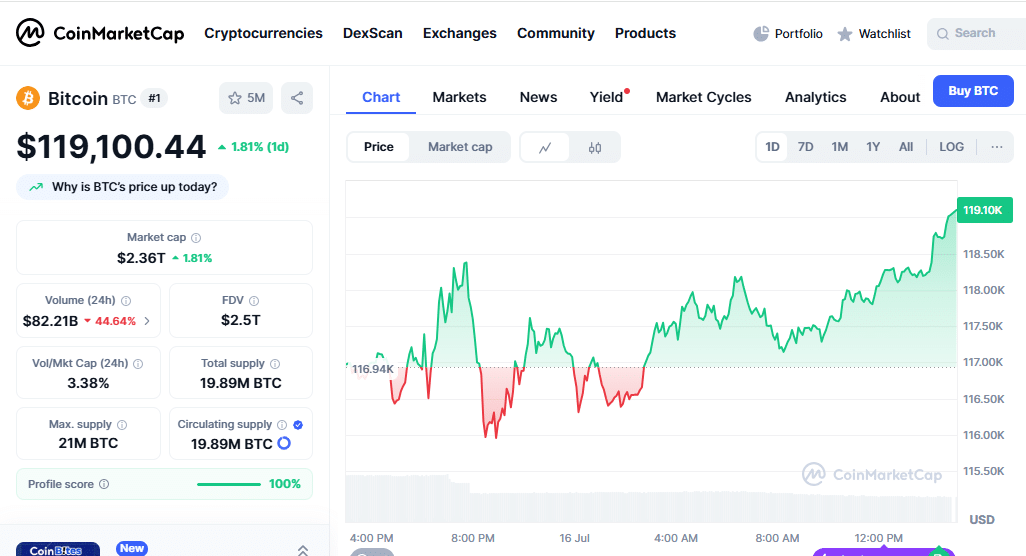

Bitcoin currently stands at $119,100, with gain of 1.81% in a day. Even though below its recent all time high of $123,091.61, it is still above a crucial support level of $110,000.

“Bitcoin has been able to maintain a solid position at around $118K after core CPI data was lower than expected, prompting speculation that the Fed will be more likely to cut interest rates in September, potentially leading to a surge of demand for bitcoin,” noted Nick Ruck, Research Director at LVRG.

Also Read: BlackRock’s Bitcoin ETF Shatters Records with $80 Billion AUM