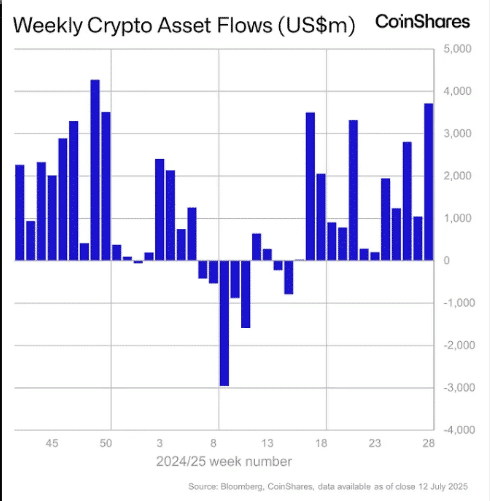

Last week, global crypto investment products saw $3.7 billion in net inflows, which is the second-highest weekly inflow ever recorded. The surge followed Bitcoin’s all-time high rally, pushing the total assets under management (AUM) to a new record of $211 billion.

Top asset managers like BlackRock, Fidelity, Grayscale, and 21Shares collectively attracted $3.7 billion of inflows in their crypto investment offerings. This represents only the December 2023 figure of $3.9 billion, which is the highest number of transactions so far, according to CoinShares.

The AUM milestone week also took global crypto fund AUM beyond the $200 billion mark for the first time in history. July 10 alone recorded the third-largest single-day inflow, pointing to the high pace of investor participation.

The inflows have now been ongoing for 13 weeks, with a total of $21.8 billion raised during that period. Global inflows have already hit $22.7 billion so far this year. Weekly trading volumes soared to $29 billion, which is twice the annual average in 2025.

U.S. markets drove the bull run with $3.7 billion in inflows. Switzerland and Canada trailed with $65.8 million and $17.1 million, respectively. However, Germany, Sweden, and Brazil faced combined outflows of $108.9 million, thus creating a slight regional divergence.

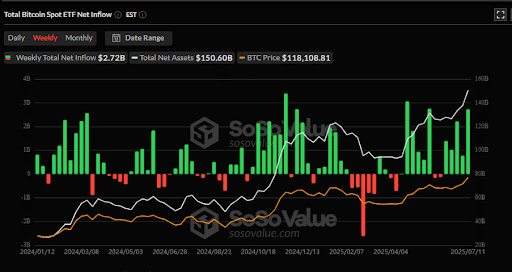

Bitcoin investment products were the main players that represented 73% of the total inflows and thus brought in $2.7 billion. Their AUM reached $179.5 billion, which corresponds to 54% of gold-backed exchange-traded products—a huge step for crypto to be recognized as one of the major players in the market.

The biggest part of Bitcoin’s inflow was executed through the U.S. spot ETFs, which attracted $2.72 billion last week alone. On the other hand, short-bitcoin products stayed mostly dormant, thus showing that bullish investor sentiment persists.

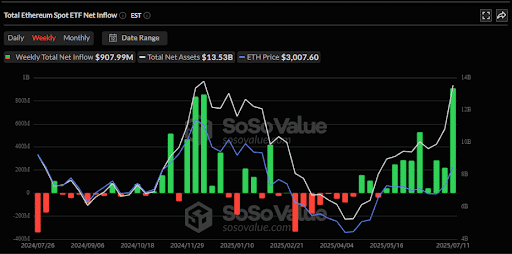

Ethereum-based funds carried out more than $900 million as their inflows, which is their fourth-highest weekly inflow. This is the ninth consecutive week of record-breaking gains for Ethereum, which is the longest streak since mid-2021, and also, the U.S. spot ETFs made the biggest contribution with $908.1 million.

Ethereum’s nine-week inflows in proportional terms are 19.5% of its AUM, while Bitcoin’s are 9.8%. This means that institutional buyers are gradually becoming more confident in Ethereum’s long-term investment potential.

Among altcoins, Solana was the leader with $92.6 million in weekly inflows. In contrast, investors in XRP products decided to pull their money out of the market, resulting in $104 million in net outflows, the biggest figure among the listed digital assets.

As the crypto fund inflows have been soaring, institutional confidence has been waxing, with Bitcoin and Ethereum setting the pace and overall market energy driving assets under management to record highs.

Also Read: BlackRock Now Manages Over 2 Million Ethereum in ETF