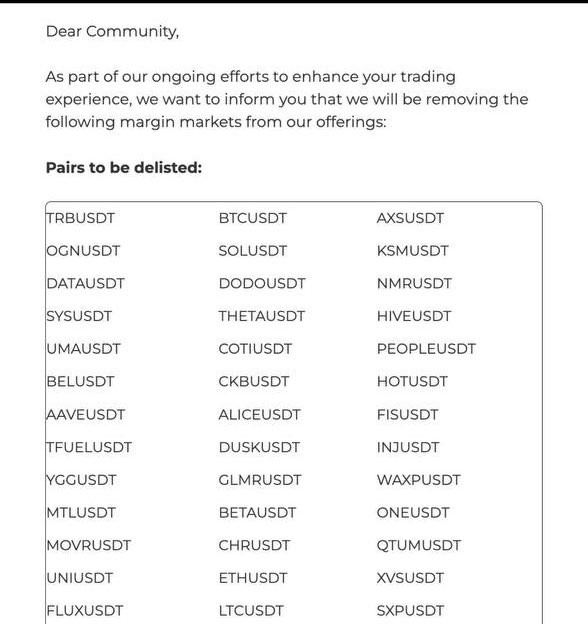

CoinDCX, one of India’s top crypto exchanges, has pulled the plug on over 50 USDT margin trading pairs, including heavyweights like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, Uniswap (UNI), and Aave (AAVE), without giving traders so much as a heads-up.

Users woke up to find positions frozen, pairs missing, and no clear explanation from the platform. The reaction? Predictably brutal. Traders took to Telegram, Reddit, and other forums, furious not just about the delisting, but about how quietly it was done.

Some had live trades open on BTC/USDT and ETH/USDT. Others had margin orders waiting to trigger. Now they’re left guessing: were positions closed forcibly? Were accounts auto-liquidated? Can they even withdraw?

CoinDCX said in a brief update that the move was part of efforts to “enhance the trading experience.” That’s it. No further clarity, no details on whether the delisting was triggered by liquidity issues, compliance concerns, or internal risk controls.

What’s especially confusing is that this wasn’t just a cleanup of dead pairs or obscure tokens. Sure, low-volume altcoins like UMA and GLMR were on the list. But Bitcoin, Ethereum, Solana, and XRP? That doesn’t add up, especially when these are among the most liquid and heavily traded assets in the world.

So what’s really going on?

Some believe CoinDCX is under pressure to reduce exposure to high-risk products like margin trading, especially as Indian regulators tighten their gaze on speculative crypto activity.

Others suspect this could be a pivot away from USDT toward more compliant options like USDC, given the rising influence of Coinbase and Circle in India’s crypto ecosystem.

But right now, those are just theories. The only thing traders know for sure is that the exchange acted without warning, and they’re being left to pick up the pieces.

The timing couldn’t be worse. Just last year, WazirX suffered a catastrophic hack, nearly ₹2,000 crore in funds gone, followed by weeks of silence. Users were locked out of their accounts, withdrawals were frozen, and the damage still hasn’t fully healed. Now, with CoinDCX taking similarly abrupt steps and refusing to clarify key questions, the déjà vu is real.

And it’s not just about technicals — it’s about trust. This kind of silent delisting without user communication breaks confidence. Traders aren’t just asking about their money; they’re asking whether Indian exchanges can still be relied on.

Update and Correction

The previous version of this article carried the headline: “Is CoinDCX the new WazirX?”, pointing to how both incidents left users in the dark, comparing with WazirX. After CoinDCX quietly pulled down the trading pairs, many on X (Previously Twitter) began drawing parallels with the WazirX hack, especially since WazirX had also frozen withdrawals without warning during its crisis. But it’s important to note that while WazirX was dealing with a full-blown hack, CoinDCX’s move was a delisting, not a security breach.

Correction: CoinDCX has now reached out to The Crypto Times to clarify things. They made it clear there’s no comparison between what happened with WazirX and their own recent move. WazirX was hacked, CoinDCX wasn’t. This was just about delisting margin pairs, not about any security issue or fund loss. Following their clarification, The Crypto Times has updated its headline to reflect that and avoid any mix-ups for readers.

Also Read: CoinSwitch Unveils 1 Lakh Web3 Tokens for INR Trading