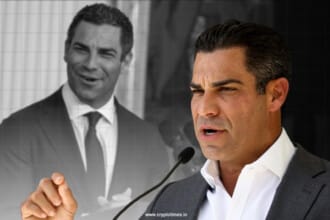

Crypto investor Anthony Pompliano believes that as Bitcoin grows in size, it becomes less risky, especially for institutional investors. In a recent Bloomberg interview, Pompliano said Bitcoin’s dominance and strong track record continue to attract smart capital allocators.

“Bitcoin is the king of this market,” he said. “Institutions look at everything, but they’re choosing Bitcoin due to its size, history, and decentralization.” Pompliano’s firm, Pro Cap BTC, is following a treasury strategy similar to Michael Saylor’s MicroStrategy.

The company plans to buy up to $1 billion in Bitcoin. They’ve already secured $750 million through equity and convertibles, with another $250 million expected from a SPAC merger. So far, they’ve purchased over 4,900 BTC.

He emphasized that Bitcoin is becoming the new benchmark, just like the S&P 500 was for earlier generations. “If you can’t beat Bitcoin, you have to buy it,” he said, pointing to its 60% compound annual growth rate over the past five years.

Pompliano also addressed Bitcoin’s volatility, saying it attracts a new generation of investors. He believes volatility is a strength that helps beat inflation. Institutional players are also using Bitcoin to improve portfolio performance. Metrics like the Sharpe ratio often improve when Bitcoin is included, he noted.

While price growth hasn’t met the wildest expectations, Pompliano pointed out many institutional investments are still hedged. As central banks start buying in, he predicts a domino effect.

Also Read: Bitcoin Could Hit $135,000 by Q3 2025: Standard Chartered