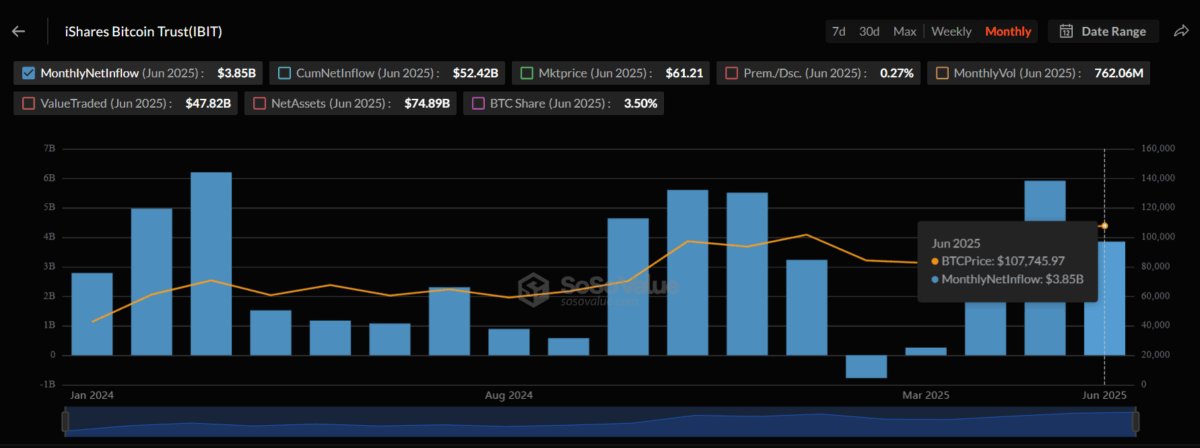

Wrapping up the month with an inflow of $112.32 million on June 30, BlackRock’s iShares Bitcoin Trust (IBIT) ETF has acquired approximately $3.85 billion worth of Bitcoin in June 2025. The ETF has also set a record with marking a 15-day inflow in all trading sessions from 9 June onwards.

Data from Sosovalue shows that the past month’s glorious inflows have pushed IBIT’s total asset value to $75 billion. The revelation underscores a seismic shift in traditional finance’s embrace of digital assets with Bitcoin playing a leading role.

This surge in IBIT ETF traction aligns with BlackRock’s dominant market presence and its partnership with Coinbase as a secure custodian. The issue has integrated Coinbase’s Aladdin risk management software with Coinbase Prime to enhance trading, custody, and reporting services for the ETF.

The June haul—which amounts to approximately 36,300 at the current price of approximately $106,000 per Bitcoin—reflects growing demand for Bitcoin exposure through exchange-traded products (ETPs).

Notably, BlackRock’s IBIT has seen consistent inflows compared to any other Bitcoin ETFs with June’s acquisition marking a 5% surge to its holdings. This move follows a continuously increasing demand for Bitcoin among traditional investors.

The total trading volume in Bitcoin ETFs now also accounts for a substantial share of trading volume compared to that of centralized exchanges. Despite this massive buy, Bitcoin’s price has struggled to surpass $110,000, prompting speculation of buyer exhaustion.

Also Read: SEC Approves Grayscale ETF with BTC, ETH, XRP, SOL, ADA