BlackRock’s iShares Bitcoin Trust (IBIT) is now bringing in more money than its flagship S&P 500 ETF, according to reports. The Bitcoin ETF is generating about $187.2 million a year in fees. This is slightly more than the $187.1 million earned by the firm’s long-running iShares Core S&P 500 ETF (IVV).

IBIT, which has an expense ratio of 0.25%, quickly gained popularity since it launched in January 2024. Even though it started out with a smaller market size, it’s proving to be more profitable for the company.

The IBIT fund has around $75 billion in assets, while IVV is nearly nine times larger with about $624 billion. But because IVV charges just a 0.03% fee, the revenue gap has now flipped. IBIT has seen inflows nearly every single month since its launch, thanks to its interest from both big institutions and regular investors.

“IBIT overtaking IVV in annual fee revenue is reflective of both the surging investor demand for Bitcoin and the significant fee compression in core equity exposure,” said Nate Geraci, president at NovaDius Wealth Management.

According to Bloomberg, IBIT has pulled in $52 billion of the total $54 billion invested in spot Bitcoin ETFs since they began trading. That means IBIT holds more than half of all Bitcoin ETF assets.

Analysts say the fund’s rise shows how much demand there was for an easy way to invest in Bitcoin without opening new accounts or using crypto exchanges. “It’s an indication of how much pent-up demand there was for investors to gain exposure to Bitcoin,” said Paul Hickey, co-founder of Bespoke Investment Group.

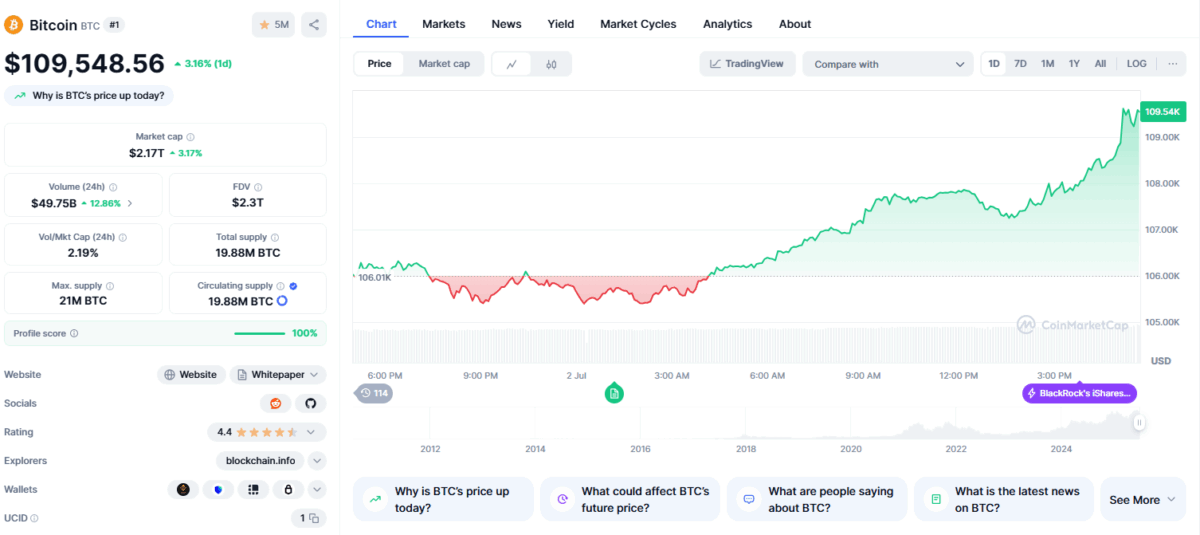

IBIT is now one of the top 4 ETFs in daily trading volume, thanks to the surge in Bitcoin, which recently hit a new all-time high of $111,970 on May 22, 2025. At the time of writing this report, Bitcoin is trading for $109,490. This is a 2% surge today from an intraday low of $105,456, with a 12% increase in its trading activity to $49 billion.

Hedge funds and institutional investors have also fueled the growth, including Michael Saylor’s Strategy, which has been buying Bitcoin consistently this year.

Both IBIT and IVV could push BlackRock ahead of State Street in ETF trading volume, according to Bloomberg Intelligence. BlackRock now controls about 25% of ETF trading by dollar volume, just behind State Street’s 31%.

Also Read: Just-In First-Ever Solana Staking ETF in US Goes Live