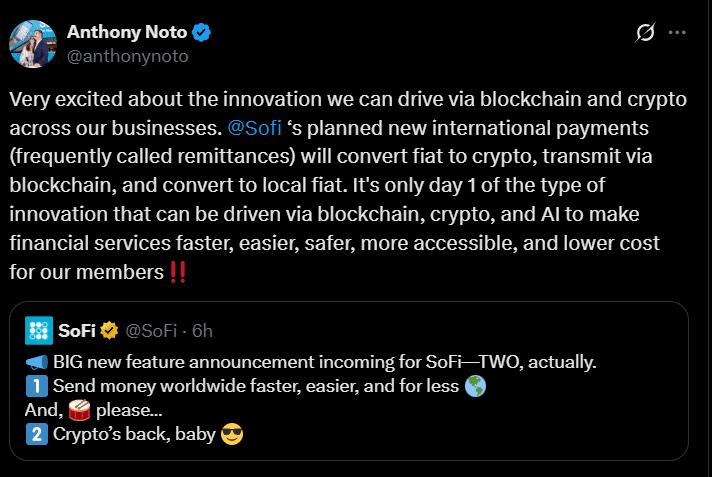

SoFi Technologies Inc. is bringing back crypto trading by the end of the year. CEO Anthony Noto confirmed in a statement. This decision came after the change in federal rules under the Trump administration that now allows national banks to offer certain crypto services.

“The future of financial services is being completely reinvented through innovations in crypto, digital assets, and blockchain more broadly,” Noto said. He added, “Crypto and blockchain innovations can and will be threaded through each of our businesses and capabilities, including buying, paying, saving, investing, borrowing, and protecting.”

The fintech company paused its crypto service in late 2023 to meet conditions required to secure a national bank charter. At that time, users were either redirected to Blockchain.com or asked to sell off their crypto holdings.

But now, new guidance from the Office of the Comptroller of the Currency (OCC) has cleared a path for banks like SoFi to re-enter the space. SoFi says its return will go beyond trading, with plans to build blockchain into savings, lending, investing, payments, and even insurance.

SoFi also wants to offer loans backed by crypto. That means users could borrow money while keeping their crypto as security. The company may add support for stablecoins too. They are digital coins that are tied to real money, like the U.S. dollar. The fintech firm says all of these features could roll out over the next 6 to 24 months, depending on how fast things move. If they buy other companies along the way, things could move even faster.

Moreover, SoFi is already having a strong year. In the first quarter of the year, the company added 800,000 new customers. It also reported a $71 million profit, which is much higher than what experts had guessed. SoFi says its loan business is also doing better, with fewer people missing payments.

Also Read: SoftBank Eyes Indian BPO Buyouts to Boost AI Integration