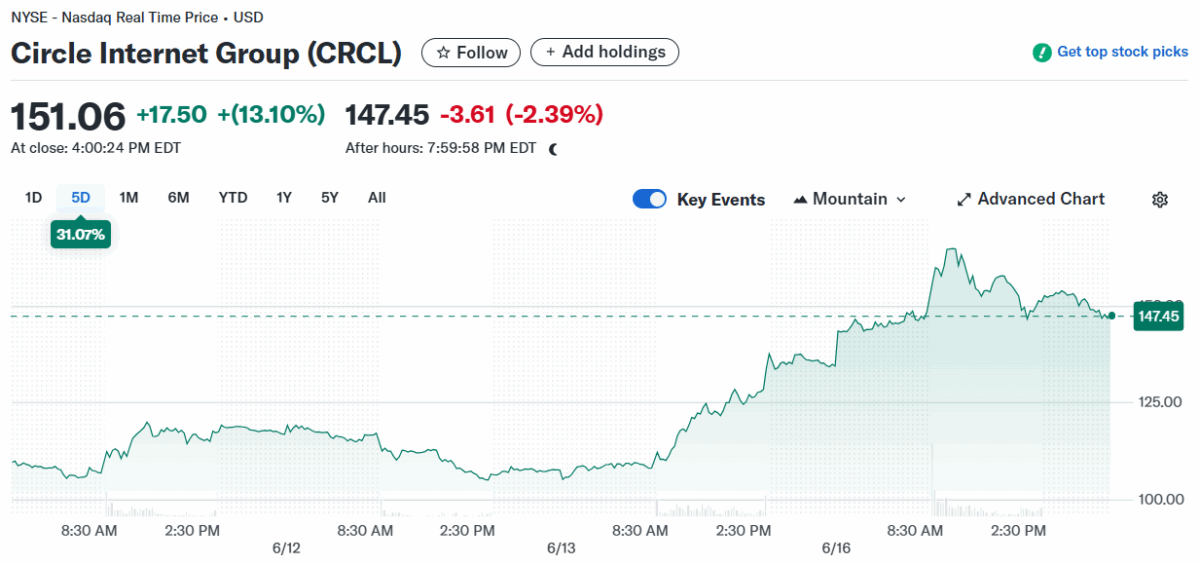

The price of Circle (CRCL) jumped to a new all-time high on June 16, reaching as high as $165.60 while closing at $151.06—marking a gain of 13.10% for the day.

The surge comes hardly two weeks after Circle’s debut on the New York Stock Exchange (NYSE) on 5 June. Its price has surged by a staggering gain of 434% from the listing price of $31 on the launch.

These spikes align with the emerging demand for crypto-related projects from traditional investors. With the grand IPO, which put Circle’s valuation soaring to nearly $7 billion, CRCL stock made history as it popped the highest gain in its first trading session.

As per Yahoo Finance data, Circle Internet Group (CRCL) stock opened and closed at $145.88 and traded as high as $165.60, accumulating a daily trading volume of $42.77 million.

This growth is attributed to steadily increasing institutional adoption and the anticipated passage of a stablecoin-friendly bill under the Trump administration. Moreover, Circle’s CEO Jeremy Allaire’s efforts to integrate USDC into mainstream finance further solidify a pathway for the company.

Although the surge has also influenced various investors to book profits, it is already offering a mammoth return from the pre-launch valuation. One of the notable sales came from ARK Invest, which reportedly offloaded approximately $51.7 million from its $373 million holding.

Also read: Justin Sun’s TRON Going Public in US After Circle IPO Success