Crypto trader James Wynn suffered a massive loss of more than $99 million in just a week, as his latest 949 Bitcoin long position was liquidated when the price of Bitcoin fell below $105,000 during early Asian trading hours.

Wynn had a position worth nearly $178 million using only $3.5 million of his perp equity. He was 100% invested in Bitcoin, showing that he believed in Bitcoin rising. Yet, the market took a different route.

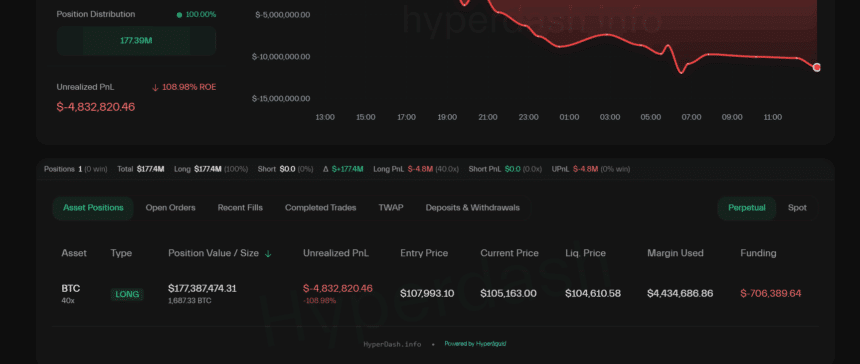

The data reveals that Wynn’s unrealized P&L fell sharply and the red line on the graph shows that there were losses every day from May 23 to May 30. After everything, his account revealed a weekly loss of $99,197,131.51, an unrealized loss of $4.39M and a return on equity of -98.84%.

Over the past 24 hours, Wynn lost another $12.8M as Bitcoin continued to fall. He started with $107,983, but the market brought his price down to $105,995, almost reaching the liquidation point at $104,607.

The recent liquidation of this loan has become a hot topic on crypto Twitter, as many discuss the risks of taking on too much debt in the crypto market. Higher leverage allows traders to gain more, but it can also be very harsh when prices go in the opposite direction.

As of now, Wynn has a 1,687 BTC long open which has a liquidation price of $104,610 and the trade is currently in loss of $4.83 million.

Wynn’s huge loss could end up being remembered as one of the biggest weekly losses in crypto—showing that risk is always there in the world of leverage.

Also Read: James Wynn’s $1B Bitcoin Short Backfires with $27M Loss