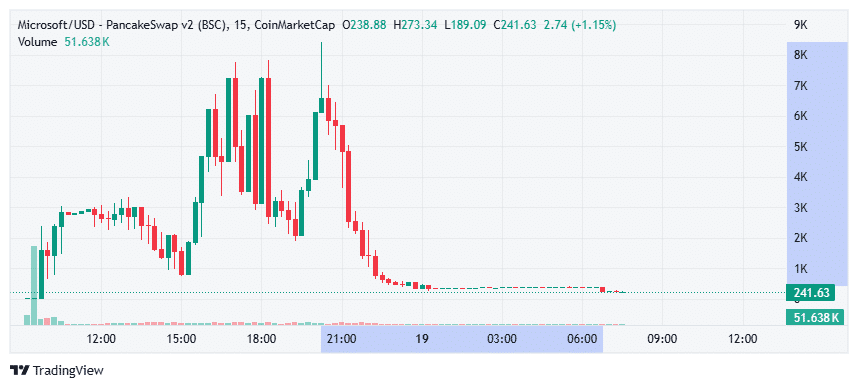

A fake cryptocurrency token posing as “Microsoft” has suffered a brutal crash, wiping out nearly 96% of its value just hours after peaking. The token, which misleadingly used the Microsoft name and logo, hit an all-time high (ATH) of $8,300 before plunging to just $386 today.

The token grabbed attention after it suddenly shot up by over 14,000% in a very short time. Its market cap touched nearly $80 million at the peak, mostly fueled by hype, confusion, and people jumping in without doing proper research.

However, reality hit soon after. The token has now crashed to a market cap of just $3.8 million, with 24-hour trading volume still unusually high at $54.4 million — likely due to panic selling and opportunistic trades.

As of there are roughly 24,000 token holders with the top address controlling 4.71% of all available tokens. Following that all other holders own bellow 0.5%. The extremely high price with this distribution was possible cause total supply cap for the token is only 10,000, making it vulnerable to volatility even with small buying or selling pressure.

CoinMarketCap has not verified the project. Its profile displays unverified branding, third-party social media links, and a clear disclaimer advising users to “Do Your Own Research” (DYOR). Despite this, the token briefly fooled parts of the community into thinking it had ties to the real Microsoft Corporation.

A lot of people on crypto forums and social media are angry, with some openly saying they jumped in at the top of the hype. It’s another harsh lesson in how fast things can go wrong in crypto, especially when you blindly chase big gains without checking if a project is actually legit.

Right now, the token is trading at around $386 — a massive drop from its fake high of $8,300.

Reminder: Just because a token uses a famous name doesn’t mean it’s real. Always double-check before putting your money in.

Also Read: Uniswap Price Crashes 15%, Will UNI Crypto Drop to $5?