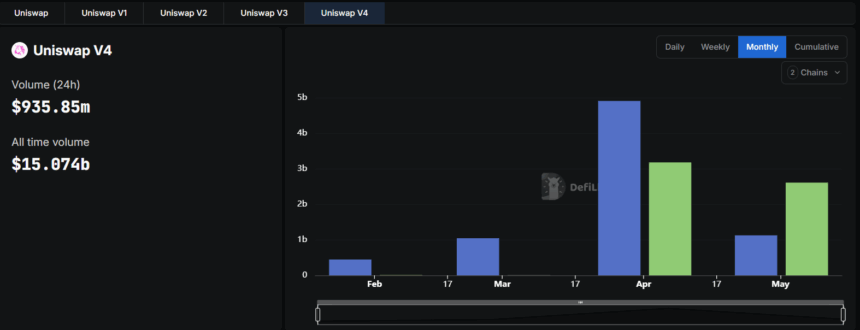

The recently launched Unichain, the native Layer-2 from Uniswap, has overtaken Ethereum as the leading chain for Uniswap v4 transaction volume. This milestone underscores Unichain’s rapid rise since its mainnet launch in February 2025.

As of May 2025, Unichain commands approximately 75% of Uniswap v4’s market share, while Ethereum’s share has dipped below 20%, as per DeFillama data.

Unichain’s dominance is driven by its optimized infrastructure, offering one-second block times and gas fees up to 95% lower than Ethereum’s Layer-1. These features, combined with a robust incentive campaign launched in April, have attracted liquidity providers and traders, boosting the total value locked (TVL) on Unichain to over $250 million.

Since May 1, Unichain has accumulated a trading volume of $2.613 billion, a surge of 56% to Ethereum’s $1.128 billion. With this meteoric rise, Unichain also accounts for the majority of Uniswap v4’s daily transactions.

The shift highlights Unichain’s appeal for DeFi users seeking faster and cheaper transactions. Uniswap v4, with its customizable hooks and enhanced liquidity pools, runs natively on Unichain and amplifies its efficiency. Meanwhile, Ethereum remains dominant for Uniswap v3, indicating a transitional phase in the ecosystem.

Analysts attribute Unichain’s success to strategic initiatives, including a $165.5 million funding plan approved in March to support network growth and liquidity incentives. Its partnerships with protocols like Circle, Coinbase, and LayerZero have further solidified Unichain’s position.

However, Ethereum’s long-term dominance in DeFi, with $59.65 billion in TVL, remains unchallenged on a larger scale.

Also Read: Sygnum: Solana Still Lacks Convincing Signs to Beat Ethereum