As Bitcoin price reclaims and breaks above $90k in swift push, institutional investors have once again started injecting capital into Bitcoin ETFs with BlackRock’s IBIT witnessing its one of the largest daily inflow of $643 million on 23 April.

The crypto market was dull since the past few weeks but Paul Atkins’s sworn as the SEC chair has sparked renewed interest in Bitcoin with the market sentiment turning utterly bullish since Tuesday.

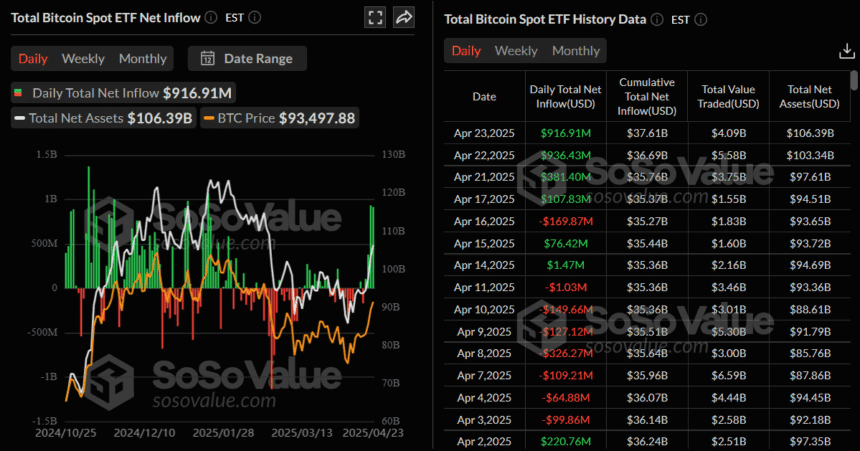

As per Sosovalue data, the U.S. spot Bitcoin ETFs have accumulated a net inflow of $916.91 million on 23rd April and BlackRock issued IBIT saw the highest among all with it bringing in $643.16 million. The total weekly inflow has reached $2.23 billion so far.

The past three days’ spot Bitcoin inflow has put this week at the top in 2025 with it having the highest weekly inflow.

With the increased trading volume and capital inflow from traditional investors, Bitcoin ETFs are now again gaining traction with seeing a 4-days streak of positive net inflows in the past 4 trading sessions.

Since their launch, the U.S. spot Bitcoin ETFs have marked a cumulative net inflow of $37.61 billion while the value of total net assets currently sitting at $106.39 billion.

Also read: Bitcoin is a Hedge Against Inflation, Like Gold: Coinbase Exec