VanEck, one of the largest asset management firms, has registered a spot Solana ETF in Delaware, signaling potential mainstream adoption of the Solana in the traditional finance landscape. This move could enhance Solana’s legitimacy and accessibility to millions of traditional investors who want to move their funds into crypto, specifically other than Bitcoin.

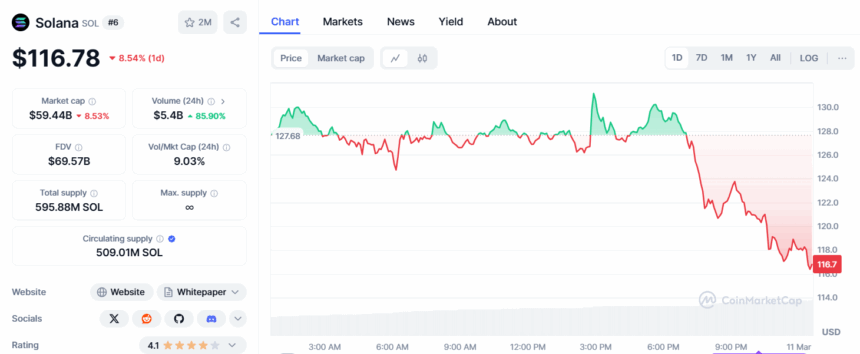

Meanwhile Solana (SOL) price has continued dropping drastically in the market sell-off followed by Trump’s “not that much interesting” crypto reserve plan. While Bitcoin (BTC), Ethereum (ETH), XRP have declined approximately 5%, SOL price is trading below $120 – down nearly 10% in the past 24 hours.

At the time of writing, SOL is trading at $116.78 with a market cap of $59.44 billion – as per coinmarketcap data.

Since hitting an all-time high of $294.33 on January 19, SOL has declined over 60% while witnessing drastic volatility.

The drop in SOL price coincides with the recent drop in Bitcoin price, which went below $80k and is currently trading at pre-U.S election levels. The recent token unlocking news has also significantly impacted the market price of SOL in the past month.

Following Bitcoin and Ethereum spot ETFs, Solana currently stands as a strong contender in the race to get a spot ETF alongside XRP. Since January 2024, when first spot Bitcoin ETFs were approved, the doors to access crypto assets have been opened for traditional investors. Now as Ethereum has also gotten an ETF, several leading crypto assets are seeking approval to be available for trading on the traditional stock markets.

Also Read: Thailand SEC Approves Tether’s USDT for Trading and Payments