Just after a day of massive pump, Bitcoin price has started to downtrend with it falling below $87k – down 5.7% in the past 24 hours. This sharp decline in BTC has stressed thousands of leverage traders with the 4 hour liquidation hitting $260 million.

The decline comes hours after U.S. President Donald Trump claimed that he will make “big announcements” on Tuesday, thereby sparking confusion and fear in the crypto markets, after a brief flicker of hope and positive push provided through the news of crypto strategic reserve being set up by Trump administration.

In such a volatile market, traders placing future trades using high leverage are often found losing their positions in liquidation due to huge price actions. When their trading position hits certain high or low price marks from the entry point and margin balance hits 0, exchange service providers automatically close their trades.

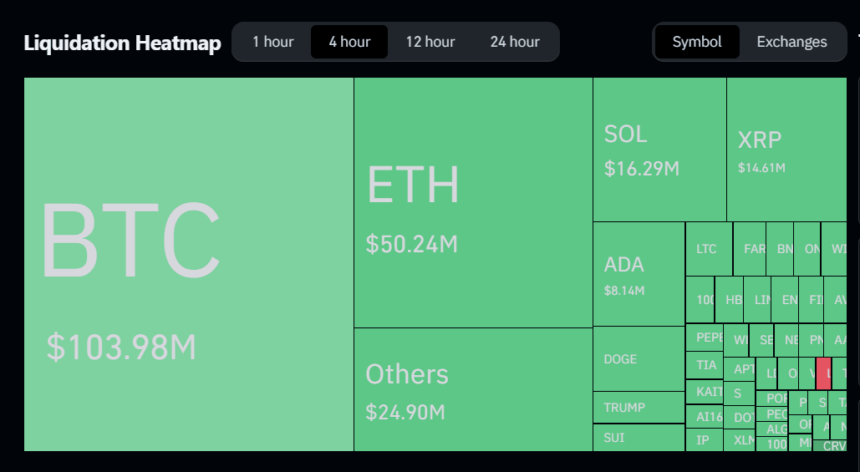

Data from Coinglass shows that Bitcoin (BTC) alone has witnessed nearly $104 million of long and short positions being wiped out while ETH following with $50.24 million.

On Sunday when the U.S. president Donald Trump first announced Strategic Crypto Reserve, the market witnessed total liquidation of over $836 million, where most of the trader lose money were in short positions.

While today, it’s mostly long traders who are losing money as Bitcoin keeps falling and other crypto assets following it. As per Coinmarketcap data, Bitcoin price pumped as high as $94,700 in the past 24 hours while it is currently trading at $86,800 – down 8.34% from the daily high.

Read: Litecoin, SOL and XRP Price Drop Ahead of Trump “Big Announcement”