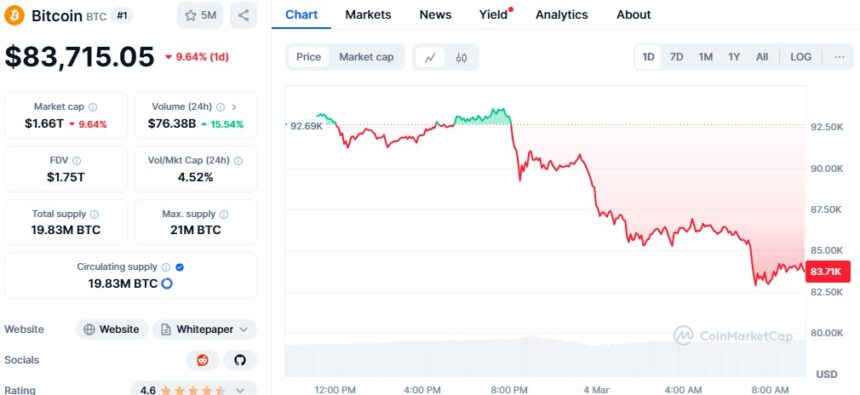

Bitcoin fell below $84,000 on Tuesday, March 4, wiping out gains from the weekend rally sparked by U.S. President Donald Trump’s crypto reserve announcement. The broader crypto market also saw a sharp reversal, losing over 10% in total value.

The digital asset market experienced a surge of $330 billion on Sunday, March 2, which elevated total crypto capitalization to $3.2 trillion before market values returned to $2.9 trillion. Major altcoins experienced double-digit losses while the market value dropped to $2.9 trillion during Tuesday trading.

Ethereum experienced a 14.63% drop, while XRP lost 17%, Solana declined 19%, and Cardano tumbled 25%. The market sell-off triggered sharp declines in stock market indices as the Dow Jones dropped 1.48% and the S&P 500 declined 1.76% while the Nasdaq lost 2.64%.

The market conditions resulted in substantial selling pressure for crypto stocks where Coinbase (COIN) dropped 4.58% and Robinhood (HOOD) lost 6.41%. The stock price of Strategy (MicroStrategy) only declined by 1.77% during this period.

The market experienced significant pressure from massive liquidations that resulted in more than $800 million worth of leveraged position losses. The market analysts predicted Bitcoin would fall below $80,000 because of CME futures gap conditions and declining market interest.

The market uncertainty has investors being cautious because Trump’s new policies involving Canadian and Mexican tariffs will start on March 4.

Also Read: Traders Lose $260M in Liquidation As Bitcoin Price Dips Below $87K