Cboe BZX Exchange has submitted applications to the SEC to list the first spot XRP ETFs in the United States, which is a major development in the world of cryptocurrency investment.

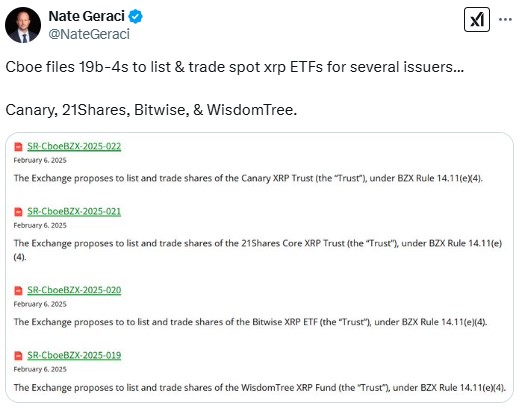

On February 6, Cboe submitted 19b-4 forms for four asset managers, namely Canary Capital, WisdomTree, 21Shares, and Bitwise. These filings seek to establish new ETFs that will replicate the price of XRP, which stands at $2.35 and is ranked fourth in the market.

The 19b-4 filings are essential to inform the SEC of proposed changes in the rules of the market. If approved, they would be the first XRP ETFs in the United States. This came after the SEC in 2024 approved Bitcoin and Ether ETFs under the former chair, Gary Gensler.

However, with the SEC now under crypto-friendly acting chair Mark Uyeda, analysts anticipate that there will be an increase in the number of crypto ETFs that are filed because issuers are probing what a Trump administration-influenced SEC will permit.

This is not the first time that Cboe has applied for cryptocurrency ETFs. The exchange recently resubmitted filings for Solana ETFs in late January, which means that it is likely that the exchange will soon approve the ETFs.

Other firms such as Bitwise and Canary Capital have also initiated the process of filing for XRP ETFs and according to JPMorgan, XRP ETFs could attract between $4 billion to $8 billion in their first year.

The interest in spot XRP ETFs is a sign of the increasing adoption of cryptocurrencies in traditional markets as XRP is approaching the all-time high of $3.40 set in 2018.

Also Read: Ripple vs. SEC: What’s Happening Now in the Legal Battle?