A crypto trader who had once made a huge profit of $11 million with the TRUMP memecoin has lost over $21 million due to a market crash caused by tariffs. The trader’s journey, which started with big wins, ended in massive losses amid the ongoing trade war sparked by Donald Trump.

The story began on Jan. 18 when the trader sold 860,895 TRUMP tokens for $23.8 million after initially investing just $12 million. This led to a profit of $11 million as the price of TRUMP rose from $13.94 to $27.67. But the success didn’t last long.

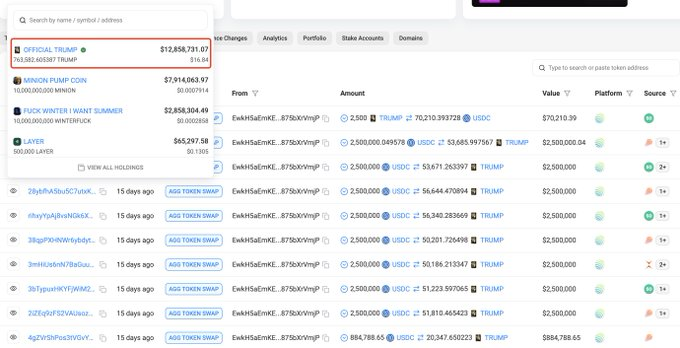

The trader decided to invest further, purchasing 766,083 TRUMP tokens for $33.9 million at $44.25 each. Shortly after this purchase, the global market took a nosedive as tariffs were imposed by the U.S. on China, Canada, and Mexico.

As a result, TRUMP’s value dropped sharply, and the trader’s holdings went down in value. Today, the trader’s 766,083 TRUMP tokens are worth only $12.85 million. This dramatic fall has led to $21 million in unrealized losses, wiping out the trader’s earlier profits and a significant portion of the original investment.

Meanwhile, cryptocurrencies have been struggling due to the unpredictable impact of the trade war. The tariffs triggered by Trump’s administration created chaos in financial markets worldwide, and cryptocurrencies were no exception. The impact of the tariffs on the market was undeniable, with some tokens, including TRUMP, losing substantial value.

The market’s downturn didn’t just affect the trader. It raised questions about the wider impact of Trump’s trade policies on the cryptocurrency world. Some have even speculated whether these actions were part of a bigger strategy.

Trump’s administration had been supportive of crypto, with members of his team showing interest in buying crypto assets like Ethereum.

Despite the losses, the U.S. President’s decision to temporarily halt tariffs against Canada and Mexico briefly boosted market sentiment. However, for many traders, including the TRUMP whale trader, the damage had already been done.

Also Read: Coinbase Urges Regulators to Let Banks Offer Crypto Services