The cryptocurrency market has been evolving as there are over 45 active filings for crypto-related exchange-traded funds (ETFs).

According to Kaiko Research, these files include initiatives to convert closed and trust funds into spot ETFs, as well as applications for memecoins like DOGE and TRUMP

Among the most ambitious are Tuttle Asset Management’s recent filings for ten leveraged ETFs. ProShares and Vol Shares have also applied for futures-based ETFs on assets like SOL and XRP, despite the absence of regulated futures markets for these cryptocurrencies in the US.

For any ETF to succeed, efficient and secure markets are essential. As highlighted by Bitwise in its XRP filings, “Manipulative trading activity on digital asset trading platforms, which, in many cases, are largely unregulated or may not be complying with existing regulations.”

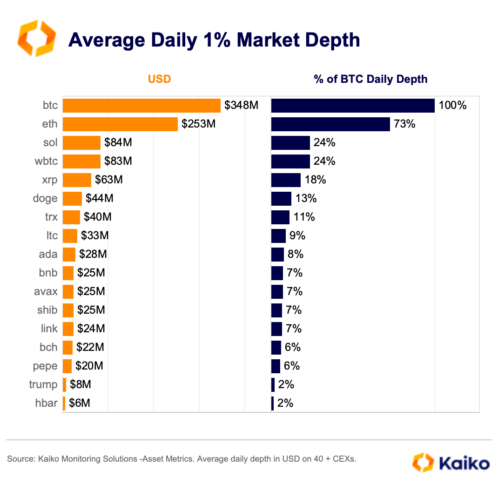

Data shows that BTC and ETH, which have active spot ETFs, have much higher liquidity than assets like XRP, SOL, and LTC. These assets are widely traded, but their market depth is low. Most assets make up less than 10% of BTC’s daily market depth.

Authorized participants such as JP Morgan and Jane Street rely on strong liquidity. The launch of BTC spot ETFs has improved liquidity, which is critical for maintaining price stability between ETF shares and the underlying BTC. However, XRP and SOL continue to have uneven liquidity, which may impede their ETF certification

Concentration risks also present challenges. 80% of crypto trading occurs on offshore platforms, which lack transparency and regulatory oversight. The lack of USD trading pairs for XRP, SOL, and LTC complicates its incorporation into regulated ETFs, making NAV computations problematic.

Despite these challenges, demand for crypto ETFs remains strong, driven by retail speculation and institutional interest.

Also Read: XRP ETF Approval in 2025 has 82% chances on Polymarket