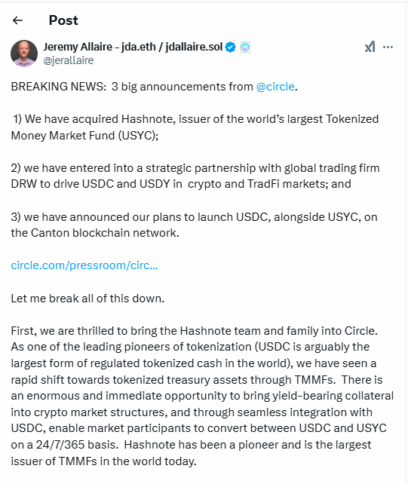

Circle, the company behind the USDC stablecoin, has bought Hashnote, a firm that issues real-world tokenized assets (RWAs). The deal was finalized this morning and announced at the World Economic Forum in Davos, Switzerland.

Hashnote has over $1.3 billion USYC tokens, which have grown into the biggest tokenized U.S. Treasury product, based on data from rwa.xyz. Details about the purchase price were not shared.

According to the press release, Circle intends to establish a connection between USYC and USDC, to facilitate the exchange of cash for yield-generating assets on blockchain platforms.

“This is a huge unlock for a market that is increasingly being driven by institutional adoption,” said Circle CEO Jeremy Allaire.

Meanwhile, Circle is also working with another company called Cumberland to help people buy and sell these digital assets more easily. The partnership promises to make USYC a common kind of collateral on exchanges and custodial platforms.

Circle also will bring USDC to the Canton Network, a blockchain on which banks and financial firms trade real-world assets. This will allow smoother transactions between decentralized and traditional markets.

Also Read: Binance & Circle Partner to Embrace USDC Stablecoin Adoption