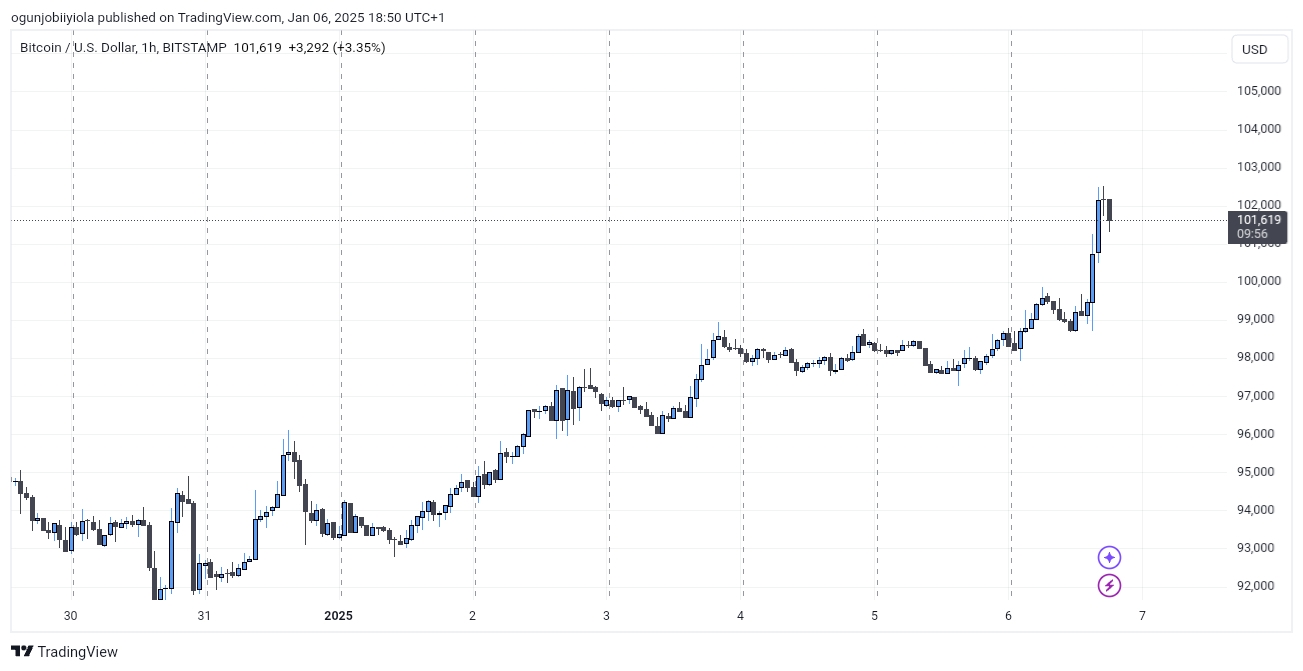

Bitcoin has rallied past $100,000 for the first time this year, hitting an intraday $101,184 on Monday after recovering from a dip below $92,000 during the holiday season. This is up nearly 11% in just one week and now, some are predicting that Bitcoin can reach $200,000 this year

One main drive that can make this forecast come true is the institutional investment in Bitcoin. Recent data from Farside Investors shows that Bitcoin exchange-traded funds (ETFs) saw $908.1 million in net inflows on Friday, which is the highest since mid-December. This means that the largest investors’ fresh appetite is once again returning and driving the price higher

Another important factor is the decreasing supply of Bitcoin on exchanges. On-chain data from Santiment reveals that more Bitcoin is being held off exchanges, while the supply on major platforms like Coinbase and Binance is shrinking. Analysts at 10X Research noted, “Significant exchange withdrawals of BTC signal that holders do not intend to sell,” which they view as a bullish sign for the cryptocurrency.

Looking ahead, several key events could influence Bitcoin’s price further. On January 15, the U.S. Bureau of Labor Statistics will release its Consumer Price Index (CPI), which measures inflation.

Analysts believe that a favourable inflation report could lead to more investors turning to Bitcoin as a hedge against inflation. “A favourable inflation print could reignite optimism, fueling a rally into the Trump inauguration on January 20,” analysts from 10X Research explained.

Bitcoin’s recent rally is also being influenced by the upcoming inauguration of President-elect Donald Trump set for January 20. Traders are of the view that his pro-crypto stance will bring about favorable policy to the space, there giving optimism a push for bitcoin.

In the technical view, Bitcoin has also broken through key resistance levels. According to trader Rekt Capital, Bitcoin will need to stay above the $101,000 range for its upward momentum to continue.

“Bitcoin will need to Daily Close and/or retest the $101k Range High to break, just like in early December 2024” he stated.

Also Read: Bitcoin’s Path to $105K Depends on Boost in Trading Volume