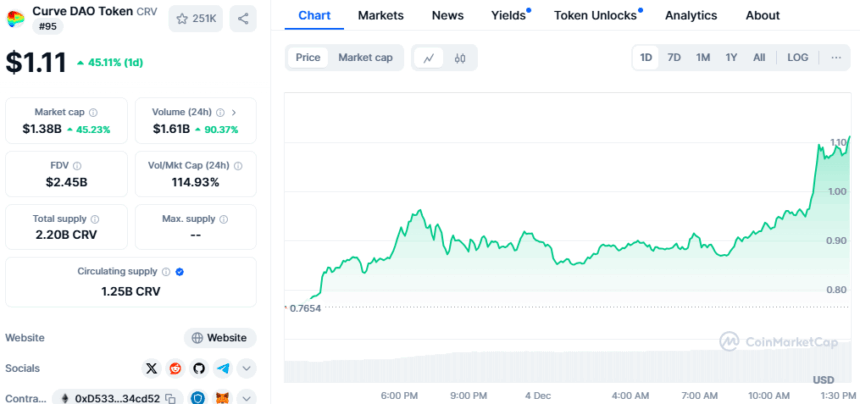

Curve DAO’s CRV token has seen an impressive 45% spike in just 24 hours, currently trading at $1.11 with at market cap of $1.38 billion.

Curve, launched in 2020, has been a pioneer in DeFi, providing liquidity solutions via automated market makers. Its DAO, powered by CRV, plays a critical role in governance and ecosystem growth.

The recent 45% surge in Curve DAO’s CRV token, alongside significant jumps in other altcoins, appears closely tied to the broader bullish momentum sweeping the crypto market following Trump’s unexpected electoral victory.

As the market reacts positively to perceived pro-business policies and potential deregulation narratives, DeFi tokens like CRV are gaining traction.

Its trading volumes surging by 93.25% to $1.63 billion underscore heightened investor activity, driven by renewed confidence.

Also Read: Altseason Frenzy: IOTA, HBAR, SAND, VET & ONDO Surge over 30%