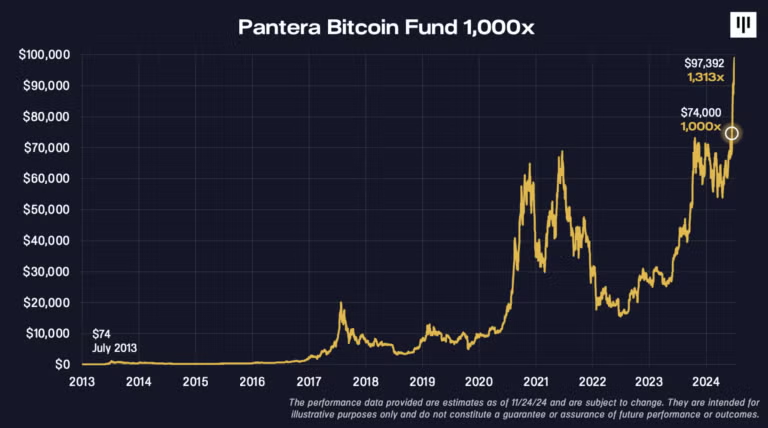

Pantera Capital’s Bitcoin Fund has recently achieved an impressive milestone, with a lifetime return surpassing 131,000% net of fees and expenses. This surge comes as Bitcoin’s price nears $100,000 following the U.S. elections.

In a recent post, Pantera Capital’s CEO, Dan Morehead, recalled a 2013 email where he forecasted Bitcoin’s meteoric rise when the cryptocurrency was valued at just $65.

According to the email, Morehead intended to personally purchase 30,000 bitcoins while the cryptocurrency’s market capitalization was about $740 million. Given the market’s limited size at the time, he stated that between 2013 and 2015, the fund purchased 2% of all bitcoins in existence.

Morehead likened purchasing Bitcoin to buying gold in 1000 B.C., suggesting that back then, 99% of global wealth hadn’t yet adopted Bitcoin. Now, with institutional giants like BlackRock and Fidelity providing affordable access to Bitcoin via brokerage accounts, he believes that only 95% of financial wealth has yet to fully invested.

The CEO added that the key factor driving this decline has “just occurred: regulatory clarity in the United States,” coupled with major institutional players like BlackRock, Fidelity, and others now providing affordable and efficient access to Bitcoin for anyone with a brokerage account.

With regulatory clarity now taking hold in the U.S., Morehead predicts Bitcoin’s price will rise to $740,000 per coin by April 2028. This would push Bitcoin’s market capitalization to $15 trillion, a figure he deems realistic given the $500 trillion in global financial assets.

Pantera Capital’s confident outlook underscores the growing institutional adoption of Bitcoin and the potential for further substantial price growth in the coming years.

Also Read: Russia Pushes Crypto Tax Reform Amid Bitcoin Surge