Bitcoin’s price recently fell to $96,000 after failing to break the $100,000 mark, leading to one of the biggest crypto liquidation events in over six months. In the past 24 hours, more than $500 million worth of crypto positions were wiped out.

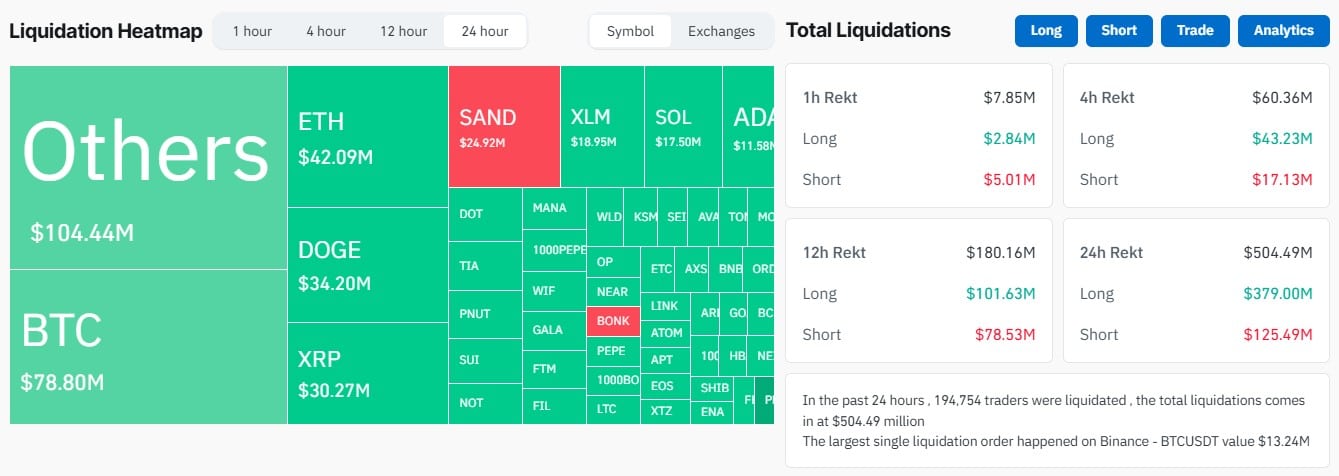

Of the total, long liquidations were $379 million, while short liquidations accounted for $125.49 million, according to CoinGlass data. Bitcoin and Ether were the main culprits, with $121 million worth of positions liquidated.

Other popular altcoins like Dogecoin, XRP, and Stellar also saw significant liquidations, with $34.20 million, $30.27 million, and $18.95 million wiped out respectively.

This major drop comes after a surprising rally in many altcoins, including XLM, which surged by 50% on November 23-24. During the same period, Dogecoin reached its highest price since May 2021, a level it last hit during its peak.

Industry analyst Miles Deutscher believes many traders from the previous market cycle are returning and investing in familiar tokens. Some see this as an opportunity, especially with utility tokens trading below their fair value.

Currently, Bitcoin is priced at $97,790, down slightly from its recent all-time high of $99,645. Despite the dip, Bitcoin has surged nearly 44% since early November. Bitcoin’s dominance now stands at 56.2% of the total cryptocurrency market, valued at $3.46 trillion.